Europe is bracing for a sharper, more transactional political economy.

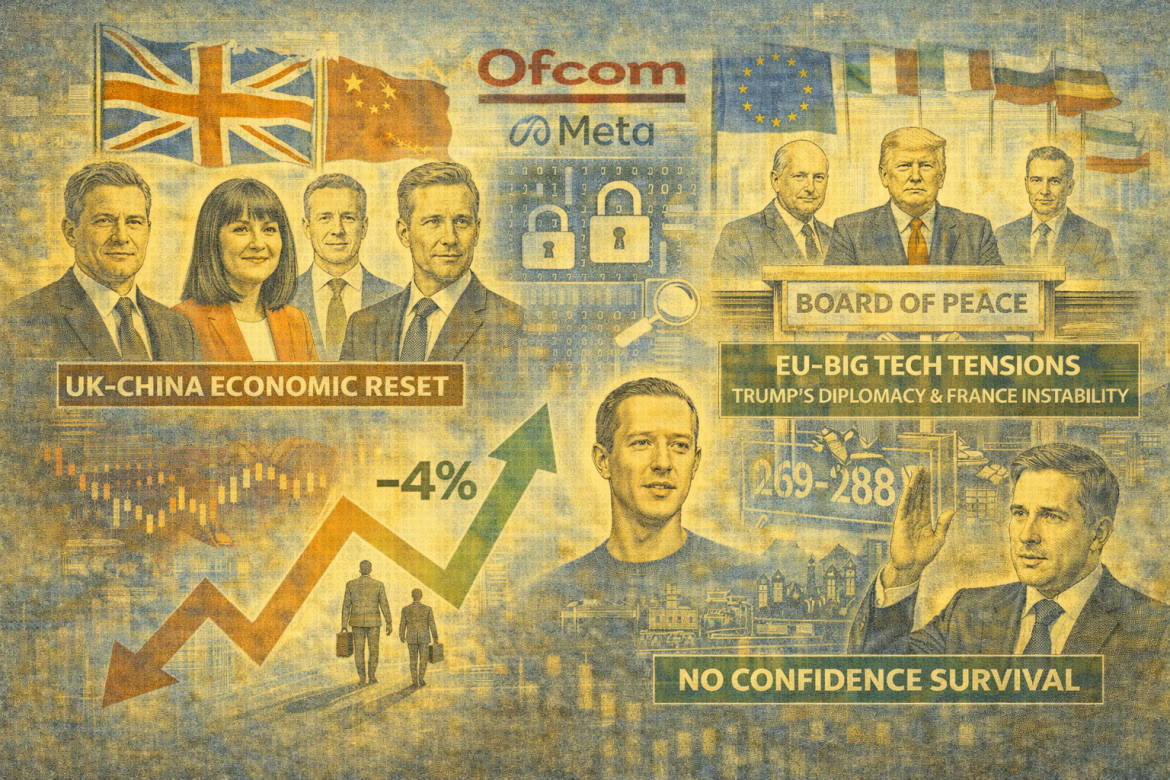

The UK is signalling an “economic reset” with China, as Starmer heads to Beijing flanked by heavyweight finance and trade figures in a bid to re-energise investment and partnerships.

At home, regulators are turning the screws on Big Tech, with Ofcom launching a formal probe into Meta’s data disclosures.

On the continent, Brussels is wary of Trump’s expanding diplomatic footprint, while France’s government survives, yet remains on thin ice.

UK signals economic reset with heavy Beijing delegation

Starmer’s bringing the full bench to China next week, Finance Minister Rachel Reeves, Business Secretary Peter Kyle, and HSBC boss Brendan Nelson in tow.

The move signals London’s dead seriousness about resetting ties with Beijing after years of cold-shoulder treatment.

This isn’t a ceremonial trip; having Treasury and Trade firepower alongside the PM screams urgency on £100 billion in annual trade.

Beijing’s already laying groundwork, hosting 30 British firms for pre-visit negotiations.

What’s the real play? Starmer’s positioning of Britain as Trump-proof, seeking Chinese capital and tech partnerships, while Washington is unpredictable on trade.

Ofcom signals crackdown on Meta’s data compliance

Ofcom just dropped a regulatory hammer on Meta, opening a formal investigation into whether the tech giant misled UK regulators on WhatsApp Business data.

The probe hinges on last year’s wholesale SMS market review, where Meta supposedly provided incomplete or inaccurate information about WhatsApp’s business messaging capabilities.

It means Ofcom suspects Meta undersold or obscured WhatsApp’s competitive threat to traditional SMS services.

Meta’s playing nice publicly, pledging “substantial resources” for compliance, but this investigation signals growing impatience from British tech regulators.

The stakes? Potential fines and tighter oversight of how Meta monetizes user data across its ecosystem.

EU sees red over Trump’s peace board power grab

Brussels just fired off a diplomatic shot across Trump’s bow; leaked documents reveal the EU’s foreign policy arm is flagging “serious concerns” about Trump’s lifetime chairmanship of his new Board of Peace.

The core gripe? The board’s charter veers wildly from its original Gaza mandate, essentially creating a shadow UN that Trump controls indefinitely.

The EU’s diplomatic service argues it violates constitutional principles and undermines UN autonomy.

Only Hungary and Bulgaria signed on; France, Italy, Germany, and Spain are sitting it out, citing governance red flags and Putin’s seat at the table.

Costa’s line? The EU will engage with Gaza, but not blank-check Trump’s geopolitical playground.

French government survives another vote of no-confidence

France’s third prime minister in 13 months just lived to fight another day.

PM Sébastien Lecornu scraped through Friday’s no-confidence vote 269–288, falling short of the threshold needed to topple his government.

His survival hinges on Socialist support, the kingmaker in France’s fractured parliament, where no party holds a majority.

Lecornu invoked Article 49.3, the controversial “nuclear option,” to bypass debate and ram through the income portion of the 2026 budget, a move that’s felled the last two prime ministers over identical overreach.

The budget targets a 5% deficit, still 200 basis points above Brussels’ 3% ceiling, making France’s fiscal trajectory Europe’s problem.

A second no-confidence vote looms for the spending portion. For markets, French government stability remains one Article 49.3 away from collapse.

The post Europe bulletin: UK courts China, Ofcom probes Meta, EU alarms over Trump appeared first on Invezz