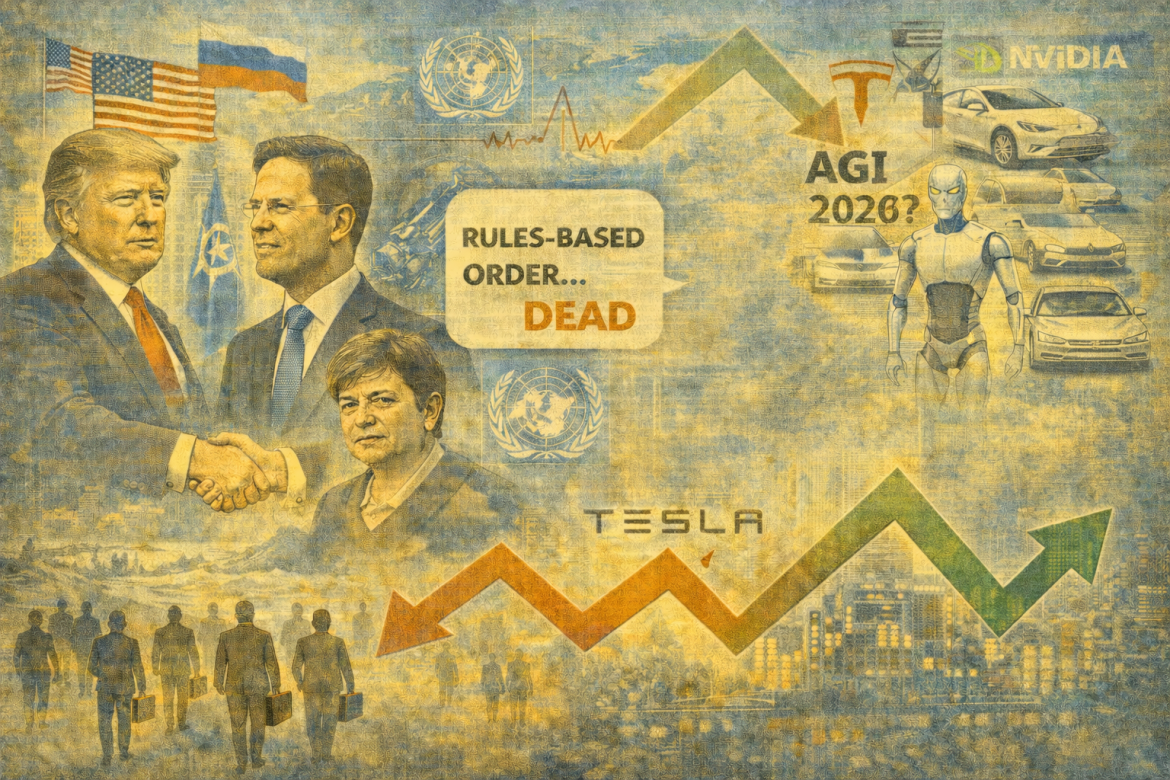

The World Economic Forum’s 56th annual meeting concluded Friday evening in Davos with a sobering realization that the international order that governed global finance and politics since World War II seems dead.

What emerged over those five days is a world fragmenting into competing power blocs, with technological disruption arriving faster than anyone expected.

The financial markets are still pricing neither the downside risks nor the upside opportunities of this fundamental shift.

Trump’s Greenland play reshapes Arctic geopolitics

President Trump’s Wednesday meeting with NATO Secretary General Mark Rutte produced a “framework of a future deal” on Greenland and Arctic security that signaled a seismic shift in how Washington views its alliances and borders.

While Trump stopped short of explicitly threatening military force, the diplomatic message was clear: NATO’s Danish ally is now negotiating how to retain sovereignty.

On Ukraine, Trump claimed he was “very close” to a ceasefire deal, but warned both Russia and Ukraine that failure to negotiate would be “stupid.”

The implicit threat was direct as the US could withdraw support if peace talks stall.

Carney declares the rules-based order ‘dead’

Canadian Prime Minister Mark Carney articulated what every major world leader had come to accept, but few will admit publicly: the rules-based international order “no longer works.”

His Tuesday speech called 2026 a “rupture, not a transition,” not a temporary disruption but a structural break in how the world operates.

His language was blunt. The multilateral institutions that governed post-war cooperation, the World Trade Organization, the United Nations, and regional development banks, are “under threat.”

In their place, countries are seeking “greater strategic autonomy” in energy, food, critical minerals, and supply chains.

Carney’s most damning observation: “When the rules no longer protect you, you must protect yourself.”

Remarkably, no major leader at Davos argued to restore the old order.

Instead, discussions centered on positioning for a new world of regional blocs: a US-led bloc, a China-led bloc, and an increasingly contested middle ground where countries like India, Indonesia, and Brazil try to navigate between rivals.

Musk compresses AGI timeline, and Tesla’s market bet

Elon Musk’s first-ever Davos appearance delivered the kind of timelines that immediately move markets.

He said Tesla expects Full Self-Driving regulatory approval in Europe by February 2026 and humanoid robots for public sale by the end of next year.

Most provocatively, he predicted artificial general intelligence could arrive by year-end 2026, with all of humanity combined surpassed by 2030 or 2031.

Tesla’s stock surged 3% on these remarks.

The market implications are enormous. Tesla’s current valuation assumes the Optimus humanoid robot will eventually become a multimillion-unit business.

If Musk’s timeline holds and these robots actually ship functional by 2027, Tesla’s addressable market expands from $2 trillion to over $100 trillion (replacement of human labor across industries).

Jensen Huang’s $85 trillion question

Nvidia CEO Jensen Huang reframed AI not as speculative hype but as the “largest infrastructure buildout in human history”: $85 trillion over 15 years.

His most revealing observation was about GPU spot prices rising, not just for the latest chips but for models two generations old.

When commodity prices rise in a supposed bubble, it signals a shortage, not excess. Huang argued this proves demand is genuine and accelerating.

Energy contracts are spiking as electricity becomes the binding constraint; companies can’t run AI without stable power. This infrastructure layer is still early stage, suggesting that capex will accelerate further.

The IMF admits what no one wants to address

IMF Chief Kristalina Georgieva stated plainly: 40% of jobs globally will be disrupted by AI in the coming years, and in advanced economies, it’s 60%.

Yet there exists no global framework for retraining, social support, or workforce transition.

Without coordinated retraining programs, she warned, AI-driven job displacement will fuel political fragmentation and populism exactly when global cooperation is most needed.

Georgieva framed the scale as “a tsunami hitting the labor market,” but the real crisis lies in the uneven distribution of opportunities.

She warned of what she called “the accordion of opportunities,” a widening gap where wealthy nations with robust education systems, digital infrastructure, and capital reserves will adapt quickly to AI, while poorer countries lack the resources to upskill workers or invest in AI adoption.

Markets are pricing an orderly transition with modest earnings growth.

They are not pricing either extreme: the downside of geopolitical chaos, collapsing trade, or the upside of AI/robotics creating markets so vast they dwarf current valuations.

The next week’s earnings season will determine which narrative dominates.

The post WEF wrap: Trump, Carney, Musk, Huang, and the end of old playbook appeared first on Invezz