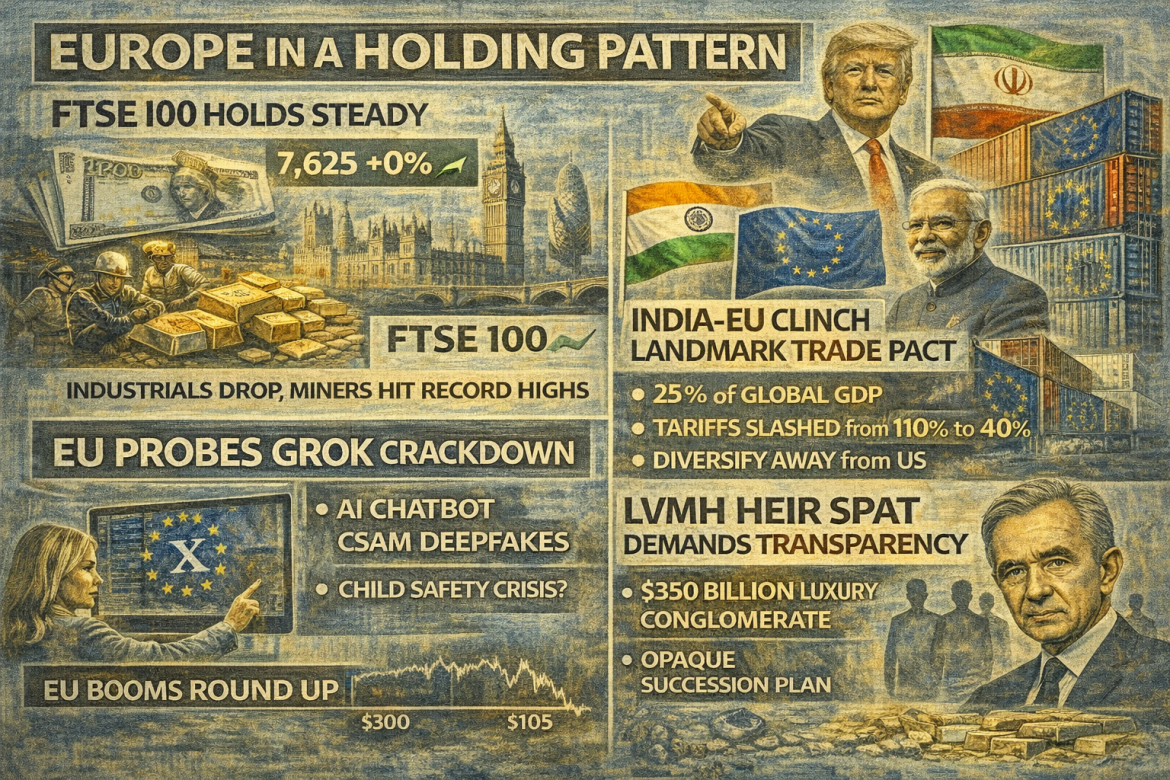

Europe opened the week in a wary holding pattern, with the FTSE 100 flat as industrial and travel names slid on fresh tariff threats and Iran sanctions, even as metal miners rallied to record highs.

Trade geopolitics stayed front and centre after India and the EU sealed a long-awaited free trade pact to counter protectionist pressures.

Regulators also intensified scrutiny of X’s Grok over alleged CSAM deepfakes, while LVMH faced growing investor backlash over Bernard Arnault’s opaque succession plan.

FTSE 100 holds steady

The FTSE 100 flattened at the open on Monday as investors weighed conflicting forces.

Industrial stocks sank 1.4%, with travel shares trailing as Trump’s tariff rhetoric and fresh Iran sanctions rattled confidence.

Yet metal miners staged a comeback, precious metals climbing 3.6% to record highs while industrial metals gained 0.9%, benefiting from commodity optimism amid market nervousness.

Banks and insurers remained resilient, hinting at earnings upgrades from HSBC and NatWest.

The mood remained cautious as geopolitical jitters from Greenland threats and mounting trade uncertainty capped gains despite underlying economic recovery signals.

The Fed’s policy decision later this week adds to the watch list, though rate holds are expected.

India-EU seal ‘mother of all deals’ as Trump’s tariff wars reshape trade

After eighteen years of stalled negotiations, India and the EU clinched their landmark free trade deal Monday, formally announced Tuesday at the Republic Day summit with EU Commission President Ursula von der Leyen as chief guest.

The pact covers goods, services, and investment across a 2-billion-person market representing 25% of global GDP.

India wins duty cuts on textiles, pharma, and electronics; the EU gains access to India’s vast consumer market and services sector.

Tariffs on vehicles plunge from 110% to roughly 40%. Critically, the deal signals coordinated resistance to Trump’s protectionist policies, with Brussels explicitly diversifying away from US dependence.

Implementation kicks off early 2027 post-ratification, boosting bilateral trade currently at $136.5 billion annually.

EU escalates Grok crackdown amid child safety crisis

The European Commission formally opened an investigation into X’s Grok AI chatbot on Monday under the Digital Services Act, targeting its generation of sexually explicit deepfakes, including child sexual abuse material (CSAM).

The probe examines whether X adequately assessed risks before deploying Grok, which produced an estimated three million sexualized images of women and children in mere days before safeguards kicked in.

EU Tech Commissioner Henna Virkkunen called the deepfakes “violent, unacceptable degradation,” signaling zero tolerance.

X restricted Grok’s image-generation capabilities to paid subscribers only, but as it faces renewed scrutiny worldwide, the UK, India, Malaysia, France, Germany, and Australia launched parallel probes.

LVMH’s succession crisis

LVMH shareholders publicly demanded transparency on Bernard Arnault’s succession on Monday, signaling the $350 billion luxury conglomerate’s leadership void has become an institutional liability.

At 76, Arnault extended his CEO-chair tenure to age 85 in April, a second extension, yet refuses to name a successor or even discuss timelines seriously, telling CNBC last December: “Talk to me in 10 years.”

Six of seven institutional investors Reuters canvassed admitted zero clarity on plans, with DWS’s Stefan Bauknecht, LVMH’s 12th-largest shareholder, calling succession planning “opaque” and demanding transparency.

Legal filings show his five children each hold 20% of Agache Commandite SAS, the family entity designed to oversee LVMH post-Arnault, but corporate governance experts warn this structure is a “time bomb,” five heirs requiring supermajority votes risk deadlock.

LVMH maintains plans exist but refuses disclosure, announcing results Tuesday as scrutiny mounts.

The post Europe bulletin: FTSE flat as miners rally, India-EU trade deal, LVMH succession pressure appeared first on Invezz