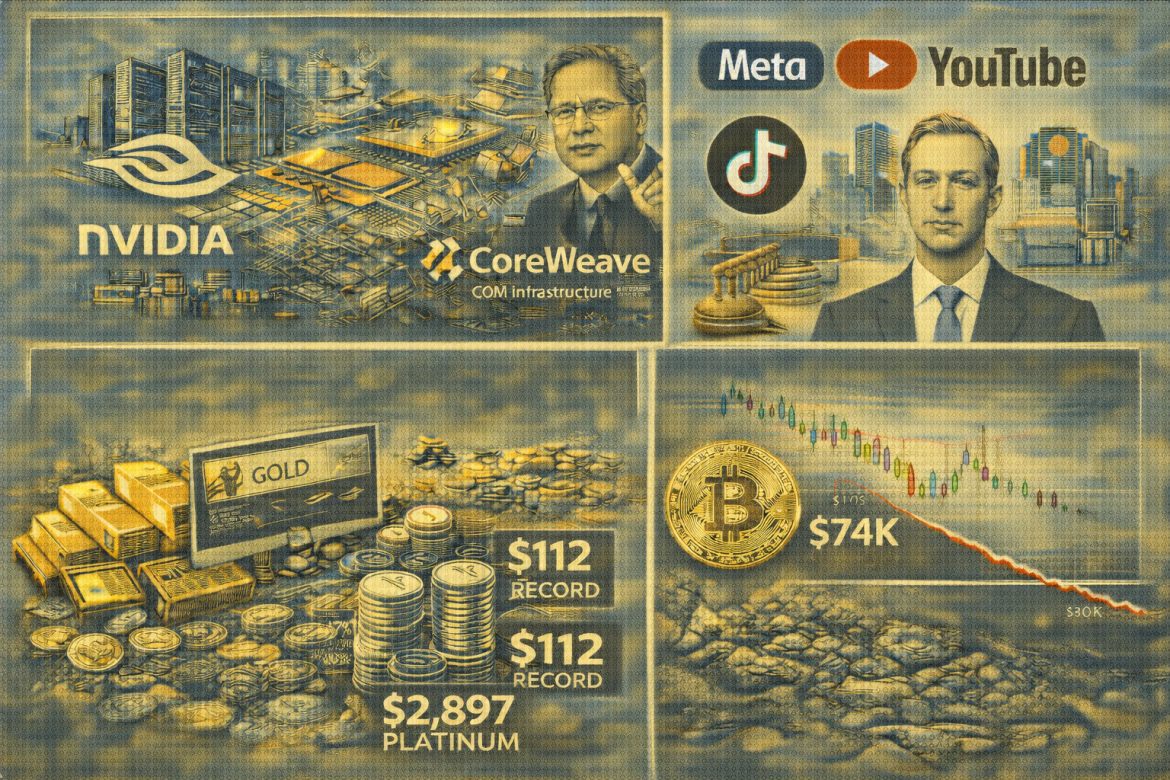

Markets opened the week with nerves on edge as Nvidia doubled down on CoreWeave in a $2 billion vote for AI infrastructure, even as sceptics questioned whether chipmakers’ funding customers signals late-cycle froth.

Risk sentiment also turned defensive as gold blasted through $5,100 and silver hit fresh records on tariff threats and geopolitical strain.

In US courts, Meta, TikTok, and YouTube faced a landmark addiction lawsuit with broader liability risks.

Bitcoin, meanwhile, hovered near a critical support zone as shutdown odds rose.

Nvidia’s $2 billion CoreWeave bet

Nvidia poured another $2 billion into CoreWeave on Monday, acquiring 23 million shares at $87.20 each to become the second-largest shareholder and cementing its strategy beyond chip sales into infrastructure dominance.

The neocloud builder now banks an additional $6 billion from Nvidia’s prior 2032 services commitment, with both firms racing to construct 5 gigawatts of AI data center capacity by 2030, roughly equivalent to powering 4 million US households.

CoreWeave will deploy Nvidia’s forthcoming CPU and storage systems first, gaining early-mover advantage on breakthrough tech.

CEO Jensen Huang framed this as foundational infrastructure for the “AI industrial revolution,” but Wall Street increasingly questions whether Nvidia funding its own customers signals an AI bubble or calculated vertical integration.

CoreWeave stock surged 12%, though recent volatility over massive debt levels, $14.2 billion to Meta, $22.4 billion to OpenAI, keeps bears circling.

Meta, TikTok, YouTube face lawsuit over addiction claims

Meta, TikTok, and YouTube face their first courtroom gauntlet on Tuesday in Los Angeles as a 19-year-old plaintiff known as K.G.M. alleges the platforms deliberately engineered addictive features driving her depression, self-harm, and suicidal ideation.

Mark Zuckerberg will testify; Snap already settled for undisclosed terms last week.

The bellwether case could trigger over 1,000 pending personal injury lawsuits, representing 1,500+ claims across the MDL, far exceeding tobacco litigation in scope.

K.G.M. claims infinite scrolling, algorithmic recommendations, and sextortion enabled by Instagram’s lax moderation (taking two weeks to address exploitation) produced clinical mental health deterioration.

YouTube argues it differs fundamentally from social media; TikTok remains silent on strategy.

Tech companies countered Tuesday morning by highlighting parental control investments and teen safety features, hiring opioid-litigation veteran lawyers from Covington & Burling to draw parallels to corporations denied addiction liability previously.

Gold vaults past $5,100

Spot gold pierced the $5,100 barrier Monday, hitting $5,110.50 intraday as investors capitulated into the ultimate fear asset amid Trump’s 100% Canada tariff threats and escalating global tensions.

The 2.2% surge extends an unprecedented 64% 2025 rally, the largest annual gain since 1979, and prices have already climbed 18% year-to-date.

Central banks remain relentless buyers, with Goldman Sachs calculating monthly acquisitions at 60 tonnes versus pre-2023 averages of 17 tonnes, while China notched its 14th consecutive month of buying in December.

The “debasement trade” increasingly dominates: investors fleeing currencies and Treasuries amid advanced-economy debt spirals and fiscal deterioration see gold as inflation-proof wealth preservation.

Silver exploded to a record $112+ an ounce, up 147% in 2025, and platinum touched $2,897.

Bitcoin caught between $88K support and $74K capitulation

Bitcoin clung to $87,000–$88,500 Monday as US shutdown odds surged to 78%, triggering a classic risk-off rotation that punished leveraged longs and widened the CME gap from weekend trading.

The structure is deteriorating: spot ETFs bled $1.3 billion in two sessions; liquidation heatmaps show dense long traps around $88,000–$89,000, making the current level a “hair-trigger zone” where momentum breaks either way.

Technical layers reveal a four-stage downside map if macro stress persists. First target: $82,000–$85,000 completes a two-month consolidation test (3–6% down).

If breached decisively, April 2025 lows at $74,000 represent the medium-term objective, a 15.6% decline that would signal the current bounce failed.

Catastrophic break at $68,000 (200-week EMA) opens $53,000 terminal flushing if broader credit stress hits.

The post Evening digest: Nvidia’s bet CoreWeave, gold breaks $5,100, Bitcoin teeters at $88K appeared first on Invezz