Geopolitical risk has sent gold soaring past $5,000 an ounce on investor uncertainty, even as energy markets remain firmly tied to tangible supply-demand constraints, according to a new Rystad Energy update.

“The message for commodity markets heading into the week is clear. Geopolitical rhetoric remains loud, but pricing continues to respond primarily to tangible constraints on supply, trade, and policy,’ Claudio Galimberti, chief economist at Rystad, said in an emailed commentary.

Unless escalation moves from words to actions, volatility is likely to remain concentrated in specific pockets—precious metals, weather-exposed energy markets, and geopolitically sensitive crude flows—rather than across the commodity complex as a whole.

Geopolitics, trade and volatility

The market for risk assets largely disregarded the Greenland incident, suggesting an immediate US-EU trade shock was improbable, according to Galimberti.

This had an impact on commodities.

Brent crude prices, which had initially strengthened due to wider geopolitical unrest concerning Venezuela and Iran, softened as the chances of near-term transatlantic trade disruption rose.

However, prices recovered as the situation subsequently de-escalated.

Crude prices remain sensitive to incremental supply risks, largely due to ongoing renewed US sanctions pressure on Iran, which continues to underpin the oil market.

A noticeable trend among middle powers to diversify economic ties was highlighted by Canadian Prime Minister Mark Carney’s proposal for “variable geometry” alliances, focusing on enhancing supply-chain resilience and energy security instead of rigid political alignment.

However, the tone sharply escalated when US President Donald Trump threatened to impose 100% tariffs on Canada if Ottawa proceeded to ratify a trade agreement with China.

Furthermore, the week saw a tense period of escalation and subsequent de-escalation between the US and Europe concerning the sovereignty of Greenland, an issue that momentarily brought the two economic blocs to the brink of a trade war.

Energy markets

The focus will continue to be on energy markets.

“Oil traders will monitor any concrete follow-through on Iran sanctions enforcement and signals from OPEC+ members, while natural gas markets remain highly exposed to weather risks,” Rystad Energy said in the update.

The recent spike in US gas prices, driven by an extreme winter storm, underscores how quickly fundamentals can overwhelm broader macro narratives when supply-demand balances tighten.

Commodity pricing in the near term will be significantly influenced by both macroeconomic data and upcoming policy decisions, the Norway-based energy intelligence company said.

Fed and macro-financial split

Attention will be focused on the Federal Reserve’s guidance following its expected decision to keep rates steady this week, particularly comments from Chair Powell.

Given that US growth has exceeded expectations and inflation is tracking forecasts, markets have scaled back anticipation for immediate rate cuts.

For commodity markets, this means the US dollar, real interest rates, and overall liquidity remain key variables, Rystad said.

A continued restrictive stance from the Fed would likely limit gains in cyclical commodities, whereas any indication of a more flexible approach could bolster energy and industrial metals.

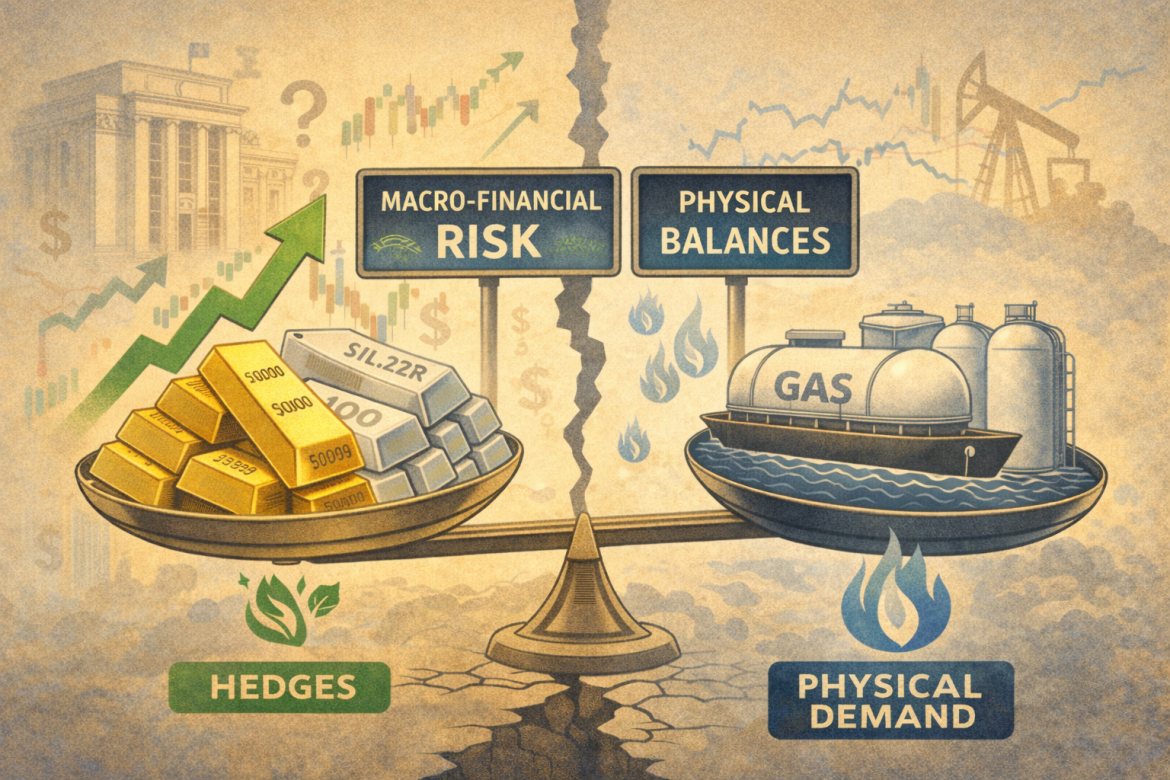

“Precious metals tell a different story,” Galimberti said.

The sustained demand for gold, now exceeding $5,000 per ounce, and silver, having risen well above $100, is a direct result of investors seeking hedges against significant policy uncertainty, growing concerns over fiscal dominance, and increasing doubts regarding the independence of the Federal Reserve.

This divergence highlights an important theme for the coming week: commodity markets are increasingly bifurcated between those driven by physical balances (e.g., natural gas) and those responding to macro-financial risk (e.g., gold).

The post Gold tops $5,000 as commodities split between macro risk and physical supply appeared first on Invezz