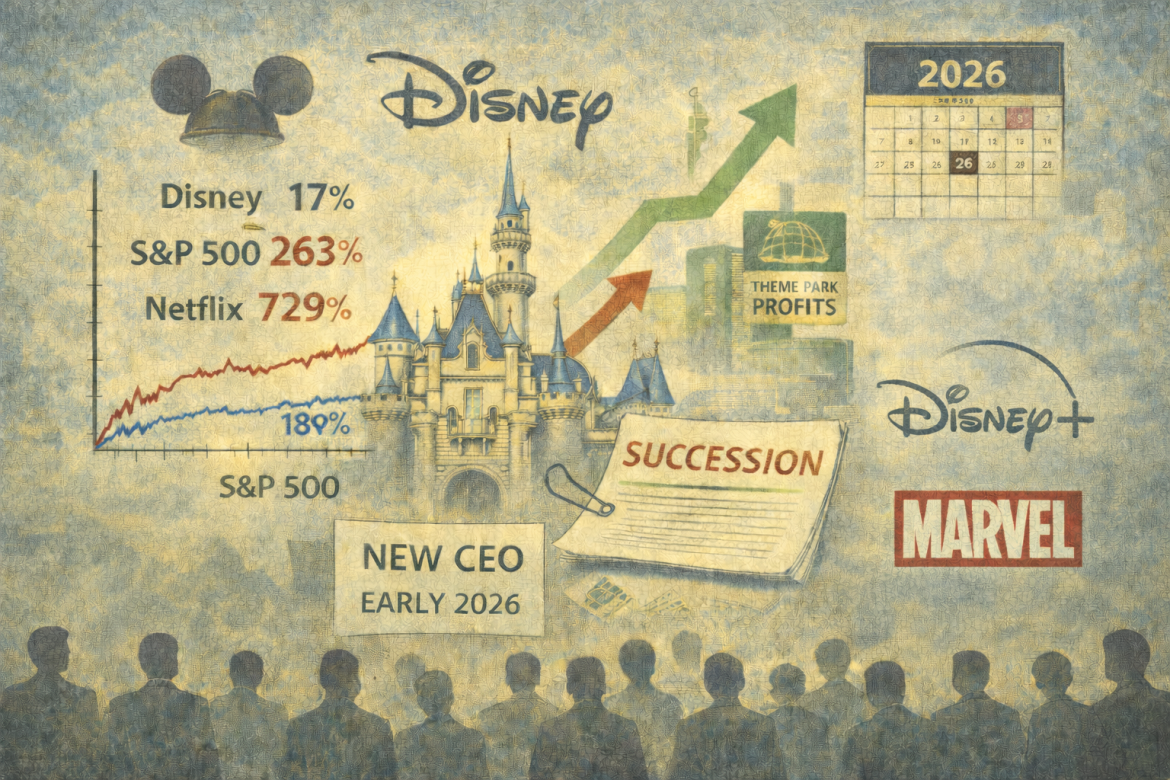

The Walt Disney Company remains on track to appoint a new chief executive early this year, as the entertainment giant moves closer to resolving a long-running succession process and faces renewed pressure to revive its underperforming stock.

In a letter to shareholders released late Thursday, board chairman James Gorman said Disney expects “to announce the appointment of the Company’s next CEO in early 2026.”

Gorman, the former Morgan Stanley chief executive, was appointed in August 2024 to chair Disney’s succession planning committee.

A decade of underperformance weighs on the transition

One of the most immediate challenges facing Disney’s next leader will be restoring investor confidence after a prolonged period of stock underperformance.

Over the past decade, Disney shares have risen just 17%, compared with a 263% gain for the S&P 500 and a 729% surge for streaming rival Netflix.

The muted returns have come despite Disney’s global brand strength and diversified businesses across theme parks, media networks, and streaming.

There have been some recent signs of improvement, with theme parks emerging as a steady and reliable source of cash flow and the Disney+ streaming platform beginning to generate profits amid intense competition.

Still, analysts and investors see the leadership transition as a critical opportunity to reset strategy and address concerns about growth, capital allocation, and shareholder returns.

Succession process intensifies under the board

Disney’s board has been working steadily toward a decision.

According to a regulatory filing on Thursday, the company’s succession committee met five times during the last fiscal year as it narrowed the field of candidates to succeed Chief Executive Officer Bob Iger.

The company reiterated that a successor will be named in early 2026, ahead of its annual shareholder meeting scheduled for March 18.

In 2020, when Iger previously stepped aside, his successor was announced roughly two weeks before the annual meeting.

As part of the process, Disney has been seeking shareholder feedback on a new compensation structure for its next CEO.

Internal candidates are undergoing what the company described as a rigorous preparation programme, including mentorship from Iger, external coaching, and direct engagement with all board members.

Bloomberg News has previously reported that four divisional chiefs are in contention, though the race is widely viewed as narrowing to two leading candidates: parks chief Josh D’Amaro, 54, and Dana Walden, 61, co-chair of Disney Entertainment.

Broader leadership changes and retention efforts

The CEO search is unfolding alongside broader leadership moves aimed at maintaining stability.

Last week, Disney said it would appoint Dave Filoni to replace Kathleen Kennedy as head of its Star Wars franchise, a significant creative leadership change within one of the company’s most valuable intellectual properties.

Disney has also renewed contracts with other senior executives, including its chief financial officer and chief legal officer, in an effort to retain key leaders through the transition period.

The company disclosed that Iger, 74, earned $45.8 million in total compensation last year, up from $41.1 million the year before, underscoring the scale of executive pay as the board seeks shareholder input on future remuneration.

As Disney approaches a pivotal leadership decision, investors will be watching closely to see whether a new chief executive can translate operational strengths into sustained shareholder returns.

The post Disney expected to appoint new CEO in 2026; why is it crucial for the stock? appeared first on Invezz