3 Lessons from the Latest Crypto Crash: Key Takeaways

- History shows that speculative assets crash when they get overextended and demand drops.

- There are many similarities between crypto promoters and penny stock promoters.

- You do NOT have to hold and hope. Learn to take profits off the table when risk increases.

How to Prepare for an Even Bigger Crypto Dip

I’m getting a ton of questions about Saturday’s Bitcoin crash. It dropped $9,836 in one hour of trading. It bounced back a little, but it’s still trading below $50,000 as I write.

So amazinggggg to wake up to see $BTC @ 47k and $ETH @ 3.9k & don’t say I didn’t warn you about the #cryptocrash as this was 10 days ago, the #cryptocurrency topping signs were all there now let’s see how far down these pumps can go! Remember the https://t.co/4lKUY5B6aw pattern! https://t.co/WdcWS9qiZ9

— Timothy Sykes (@timothysykes) December 4, 2021

This isn’t the first crash I’ve been through. And I’m sure it’s not the last. Speculative assets do this all the time.

Trading Lessons from Previous Crashes

Traders lose money — 90% of traders lose. Part of the reason I got into teaching is because I see so much BS. Again, this isn’t my first crash.

It’s also not my first warning. In 2014 I took on the Wolf of Weed Street. I battle fake gurus and their Twitter pumps all the time.

Now Bitcoin people say “This is revolutionizing the world, it’s only the beginning.” Maybe that’s true. At the same time you don’t have to hold through a 30% drawdown off the highs.

Even though I warned about a potential crash, one of the questions I’m getting is…

Why Did Crypto Crash?

Anything that goes parabolic, especially in times of excessive liquidity, eventually comes down. So much of the buying was stimulus check or dumb money buying.

When Omicron scared the market on Black Friday, smart money went to safety. Top traders trimmed positions just in case. On Saturday, spot selling triggered a tsunami of Bitcoin futures liquidation.

Could Bitcoin Crash 90%?

Bitcoin and a lot of other speculative assets have gone up further than I ever anticipated. I totally underestimated it. But that’s true of penny stock pumps, too. Understand that they all eventually crash. Most penny stocks crash 90% or more.

So people are asking if I think Bitcoin will crash 90%. I don’t know. I doubt it will go that far down. One smart thing crypto promoters have done is to control the supply. But it could go down more.

Buying the Bitcoin Dip

If the crash is big enough it creates the perfect dip buy opportunity. But is this it? On Saturday, El Salvador President Nayib Bukele tweeted “El Salvador just bought the dip!”

For me, I wouldn’t buy the dip here. But I do think you should learn the dip buy strategy. Preparation is key. With that in mind…

3 Lessons from the Latest Crypto Crash

Here are three lessons from the latest crypto crash. Add them to your knowledge account. Again, this isn’t the first and it won’t be the last. The best you can do is prepare now for the future.

Trading Lesson #1: Hold & Hope Is Not a Strategy

I get DMs and emails from people saying “This time it’s different.” Those are the four most expensive words in the English language.

There’s always risk. With speculative assets there’s greater risk.

Newbies should REALLY study history & remember to lock in profits along the way, if you continue to hold worthless or near worthless bubble assets that drop 80-90-100% in the long run, it doesn’t matter how high they go since too many people will hold all the way down & lose big!

— Timothy Sykes (@timothysykes) December 6, 2021

By all means, learn about speculative assets like crypto and Pokémon cards. I think you should learn about them.

But hold & hope makes no sense. It’s not a winning strategy..

Instead, follow…

Trading Lesson #2: Take Profits Into Strength

You don’t have to hold through big drops. The Bitcoin fail on Saturday was 13% in less than an hour. And I get it, most people were asleep and woke up to their Bitcoin wallet being a lot less.

At the end of October I warned people. Please read “Is This the Beginning of a Crash.” It explains how Robinhood Markets, Inc. (NASDAQ: HOOD) is almost a barometer for this bubble.

Here’s an up-to-date HOOD chart…

The stock is falling off a cliff because its business is falling off a cliff. Even before crypto dropped 30%, Robinhood reported average revenue per user is down 36%. Why? because all the idiots are trading less. They have less money. And they’re losing instead of winning like they did early on in this stimulus check funded bubble. That’s bad for Robinhood’s business.

To those saying this isn’t a bubble: the marketcap of US equities is $68 trillion now, nearly 3x the $23 trillion level of US GDP. At the 2000 peak, the record was “only” 1.9x GDP. Present ratio of US marketcap to GDP is 50% above levels that we’ve never seen! Thx @hussmanjp

— Timothy Sykes (@timothysykes) December 6, 2021

When Bitcoin hit new highs in November, promoters said “Sykes doesn’t know what he’s talking about. Bitcoin is going to $100,000 by the end of the year.”

How wrong they were. Taking some off the table then would have put them in a better place today. And that brings up the third trading lesson from this crypto crash…

Trading Lesson #3: You Do NOT Have to Listen to Others

Look, I’m not knocking crypto or the blockchain. I think blockchain technology has promise. But at the same time it’s stupid to not lock in profits.

I keep hearing people say you can’t time the markets so just put $ into any groundbreaking technology no matter the price as it’ll perform well over time. This is one of the biggest misconceptions as you never have to “invest” in any asset up too much, wait for pullbacks/crashes

— Timothy Sykes (@timothysykes) December 4, 2021

You don’t have to have diamond hands. “You only live once” is not a way to lasting wealth. Listening to unethical promoters when you’re losing more and more is ridiculous. You don’t have to listen to anyone else.

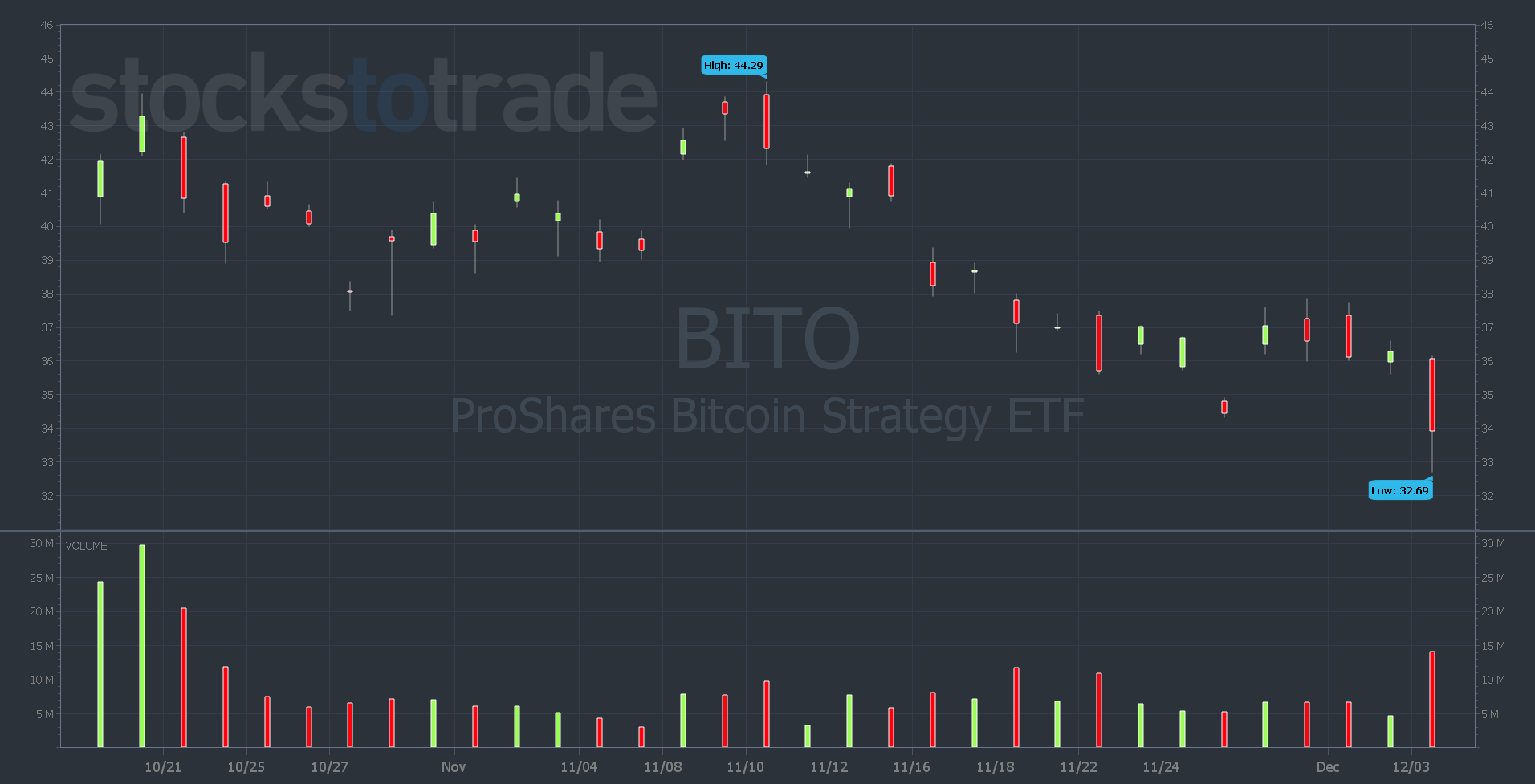

The ProShares Bitcoin Strategy ETF is a good example. It started trading in October. Here’s the chart…

When BITO started trading, there was a chorus of “Oh my god, all this institutional money is coming to Bitcoin.” But BITO doesn’t deal with actual Bitcoin so it didn’t increase demand. As it turns out, so far it’s a bad investment.

I know crypto has been a fantastic performer over the years. So I’m not saying everything is a scam that’s going to zero. But you need to understand…

The Truth About Unrealized vs Realized Profits

There are a lot of people who became paper millionaires the past year and then lost most of it. It’s absolutely crazy. If you’re really good — so good that you can do it again — why not take something off the table and then build back up?

Gamblers never make money in the long run. Gunslingers might make money during a bubble. But when things change and they don’t adapt… decimation.

This bubble is getting very frothy and very risky. We’ve had a huge run up in so many different assets. All my millionaire students and I lock in profits. We’re not unrealized millionaires. We’re realized gains millionaires. There’s a difference. Have discipline — don’t fall for the BS.

Trading Education Resources

All I can do is try to teach rules that I’ve learned the hard way over twenty-plus years. I hate seeing good money and solid profits go to waste due to poor discipline and misinformation. It’s your choice.

To learn more about how I trade panics, watch this special presentation. (Hint: I’ve been using this pattern for over two decades.)

If you’re ready to take a deep dive and learn all my strategies, apply for the Trading Challenge today.

What do you think of the 3 lessons from the latest crypto crash? Comment below, I love to hear from all my readers!

The post 3 Lessons From the Latest Crypto Crash appeared first on Timothy Sykes.