Nvidia Corp. is nearing a deal to invest roughly $20 billion in OpenAI as part of the ChatGPT maker’s latest funding round, reported Bloomberg, citing people familiar with the matter, marking what would be the chipmaker’s single largest investment to date.

The contribution is close to being completed, the sources said.

The deal is not final, and terms could still change.

OpenAI is seeking to raise up to $100 billion in the round, which could value the company at around $830 billion, Reuters reported last week.

At the same time, a Financial Times report said Nvidia’s H200 chip sales to China have been delayed due to a US national security review.

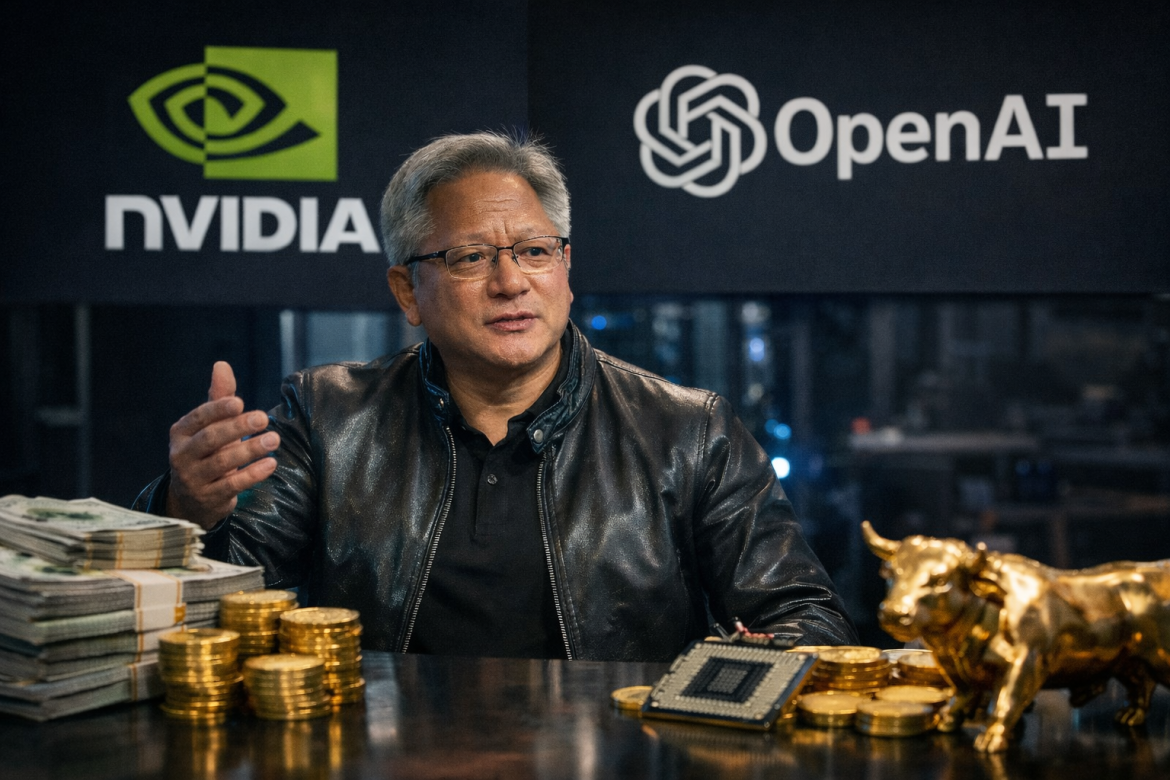

Nvidia’s biggest bet yet on OpenAI

The talks underscore Nvidia’s growing financial commitment to OpenAI at a time when both companies are central to the global artificial intelligence boom.

Nvidia Chief Executive Jensen Huang has publicly signalled support for the investment after reports last year suggested tensions between the two firms.

The Wall Street Journal reported earlier that a plan announced by Nvidia in September to invest as much as $100 billion in OpenAI and supply it with data centre chips had stalled after some inside the chipmaker expressed doubts.

That deal had been expected to close within weeks, but negotiations dragged on for months.

Huang has since denied claims that he was unhappy with OpenAI.

Speaking on Saturday while visiting Taipei, he said Nvidia plans to make a “huge” investment in OpenAI, likely its largest ever.

Huang also told CNBC earlier on Tuesday that Nvidia would consider investing in OpenAI’s next fundraising round and the startup’s eventual initial public offering.

Big tech lines up for OpenAI funding round

OpenAI’s latest fundraising effort has drawn interest from several large technology groups racing to deepen ties with the artificial intelligence startup.

Companies including Amazon.com Inc. and SoftBank Group Corp. are exploring potential investments, betting that closer partnerships could provide an edge in the intensifying AI race.

Bloomberg has reported that Amazon has held discussions to invest as much as $50 billion, while SoftBank has talked about investing up to $30 billion.

The Financial Times previously reported that Nvidia might invest up to $20 billion.

Despite their close relationship, Reuters reported on Monday that OpenAI has been dissatisfied with some of Nvidia’s latest AI chips and has sought alternatives since last year, potentially complicating ties.

OpenAI Chief Executive Sam Altman responded after the report, saying Nvidia makes “the best AI chips in the world” and that OpenAI hopes to remain a “gigantic customer for a very long time”.

China chip sales add another layer of uncertainty

Separately, Nvidia’s H200 AI chip sales to China remain uncertain nearly two months after US President Donald Trump approved exports, pending a national security review, the Financial Times reported.

Chinese customers have reportedly held off placing orders until licensing conditions are clarified.

In January, the US Commerce Department eased export curbs on the H200 for China but required licence applications to be reviewed by multiple agencies.

According to the FT report, the Commerce Department has completed its analysis, while the State Department has pushed for tougher restrictions.

Huang said last week he hopes China will allow Nvidia to sell the H200 in the country and that the licence is being finalised.

Reuters reported last month that China had approved its first batch of Nvidia H200 chips for import, signalling a possible shift as Beijing balances AI demand with domestic development goals.

The post Nvidia to invest $20B in OpenAI even as its China chip sales stalled: report appeared first on Invezz