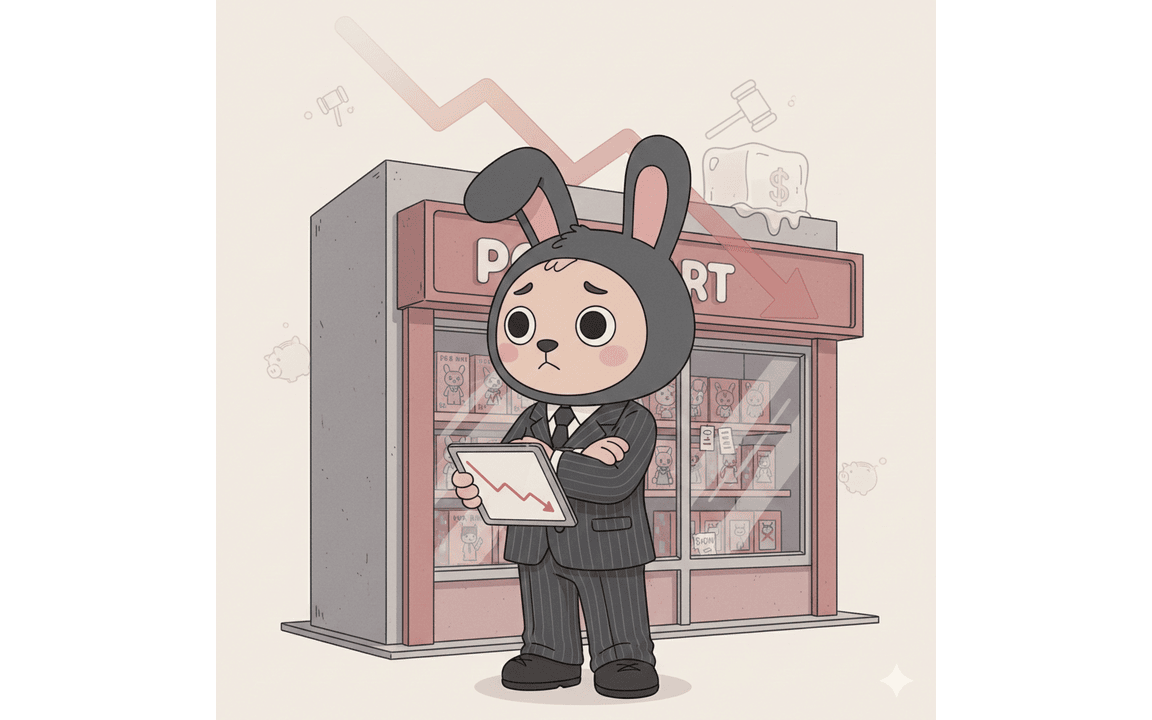

Pop Mart International Group Ltd., once one of Hong Kong’s hottest stocks, is facing growing investor skepticism as signs emerge that the global craze for its Labubu character may be cooling.

Shares of the Chinese pop toy maker have fallen about 40% from their peak, erasing tens of billions of dollars in market value and reviving comparisons to past collectibles booms such as the 1990s Beanie Babies phenomenon.

The selloff reflects concerns that demand for Labubu — the sharp-fanged character that powered Pop Mart’s dramatic rally from 2022 lows — may be peaking, raising doubts about the durability of the company’s growth story.

Growth slows after explosive expansion

One of the key triggers for the renewed bearishness was weaker-than-expected US holiday performance.

According to alternative data provider YipitData, Pop Mart’s North America revenue growth slowed to 424% in the current quarter through December 6, more than halving from the previous quarter.

While still exceptionally high, the deceleration rattled investors accustomed to triple and quadruple-digit growth rates.

Bearish bets against the stock have surged, with short positions tripling since November to their highest level since August 2023, according to S&P Global data.

Pop Mart has also become one of the worst performers on Hong Kong’s Hang Seng China Enterprises Index, with a two-day slump in early December wiping out nearly 14% of its value and pushing losses since August’s peak to roughly $24 billion.

Analysts say the market’s focus has turned sharply toward near-term performance.

“The biggest question is if it can’t sustain a very high year-on-year growth rate toward year-end, then can it still deliver growth next year with such a high base?” said Richard Lin, chief consumer analyst at SPDB International Holdings in a Bloomberg report.

Warning signs from resale markets

Adding to investor unease is softening pricing in the secondary market, often seen as an early indicator of waning enthusiasm for collectibles.

While Labubu still dominates trading volumes on resale platforms such as StockX, prices for many popular editions have fallen sharply from their peaks.

Some items that once sold for double or triple their retail prices now trade below list price.

For example, the sherbet-colored Big Into Energy series sells for about $110, down from nearly $400 at its peak and below its $168 retail price.

Rare editions still command premiums, but even those prices have retreated significantly from earlier highs.

Search interest on Google has also cooled since peaking over the summer, despite aggressive US marketing efforts that included appearances at the Macy’s Thanksgiving Day Parade and the Empire State Building.

Long-term potential still debated

Despite the stock’s slide, Pop Mart’s underlying business performance remains strong.

First-half 2025 revenue jumped to 13.9 billion yuan ($2 billion), more than five times its 2020 full-year sales, driven largely by overseas expansion.

Sales growth reached as high as 250% in the three months ended September.

The company is also investing heavily in building a broader entertainment ecosystem, including opening a large theme park in Beijing, developing animated content, launching its POPOP jewelry brand, and exploring a potential Labubu movie project.

Many sell-side analysts remain constructive, with an average 12-month price target implying significant upside from current levels.

However, some investors remain cautious. “Having conviction on Labubu is difficult — it’s discretionary spending and inherently hard to model,” said Daisy Li, a fund manager at EFG Asset Management.

For now, Pop Mart faces a critical test: proving that Labubu is more than a fleeting trend and that it can build enduring franchises capable of sustaining growth beyond the current cycle.

The post Pop Mart stock plunges as Labubu craze starts to fade appeared first on Invezz