CONSUMER sentiment deteriorated in the second quarter due to concerns about inflation, low incomes, and persistent high unemployment, the Bangko Sentral ng Pilipinas (BSP) said, though it noted that the outlook is more positive over the next 12 months.

The BSP confidence index for the second quarter of the year fell to 6.4% in the first three months of the year from 9.3% in the final quarter of 2021, according to the results of its Consumer Expectations Survey issued on Friday.

“Respondents’ less upbeat sentiment for Q2 2022 stemmed from their concerns about: (a) the faster increase in the prices of goods, (b) low to no increase in income and (c) high unemployment rate,” the BSP said in a statement.

Inflation is likely to breach 5% in May led by food and oil prices amid disruptions in global supply chains.

Inflation is likely to breach 5% in May led by food and oil prices amid disruptions in global supply chains.

A BusinessWorld poll of 16 analysts yielded a median estimate of 5.4% for May inflation, the highest in more than three years, matching the midpoint of the 5% to 5.8% forecast by the BSP.

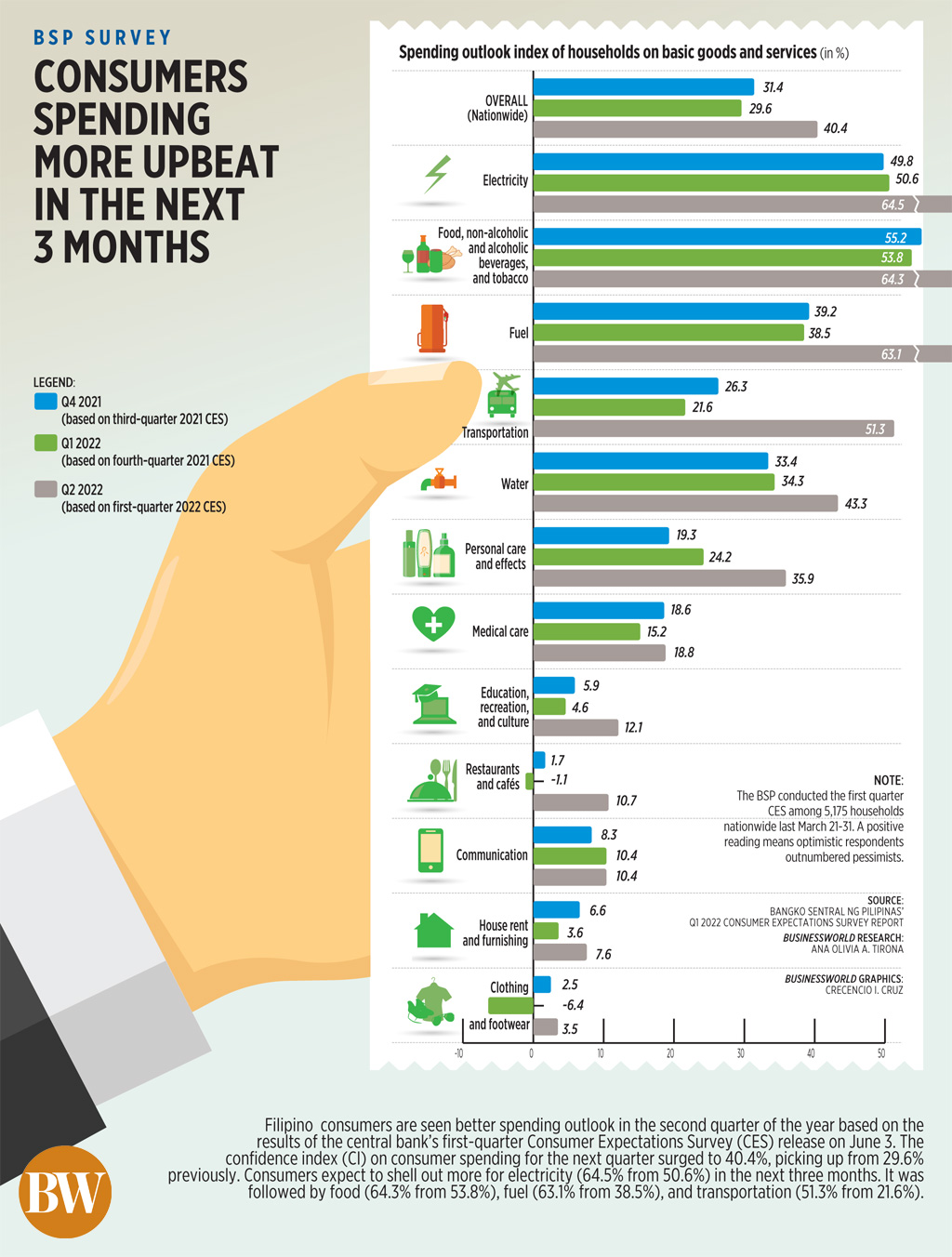

Some 40.4% of households surveyed said they expect increased spending on goods and services for the second quarter, from 29.6% at the end of 2021.

Households reporting a positive outlook for the next 12 months rose to 30.4% from 23.6% at the end of 2021.

“Respondents attributed their brighter year-ahead outlook to expectations of: (a) more available jobs, (b) additional and high income, (c) good governance and (d) salary increase,” the BSP said.

The survey indicated that households that consider the next 12 months a favorable time to buy big-ticket items increased to 5.7% from 5.1% at the end of 2021.

Respondents planning to buy property within the next 12 months increased to 6.3% from 4.2% previously. This was driven by the higher number of households that plan to acquire single-detached houses (at 52.1% from 39.4%), and apartment units (at 2.6% from 0.8%).

“When asked about the price range of real properties they intend to purchase in the next 12 months, majority, or 57.5% of the households indicated a range of P450,000 and below,” the report said.

Consumers expect interest rates to increase in the current quarter, the next quarter, and the next 12 months, the survey found.

Some 6.9% and 7.4% of households expressed their intention to apply for a loan in the second quarter and in the next 12 months, respectively.

Most respondents plan to seek unsecured loans.

The central bank’s latest Consumer Expectations Survey was conducted from March 21 to 31.

The BSP surveyed 5,282 households, with 2,720 (51.5%) from the NCR and 2,562 (48.5%) from the rest of the country. — Keisha B. Ta-asan