Hey, trader. Tim here.

Losing small is my mantra.

However, many of you struggle to put it into practice.

Simply put, you don’t know how to define your trades.

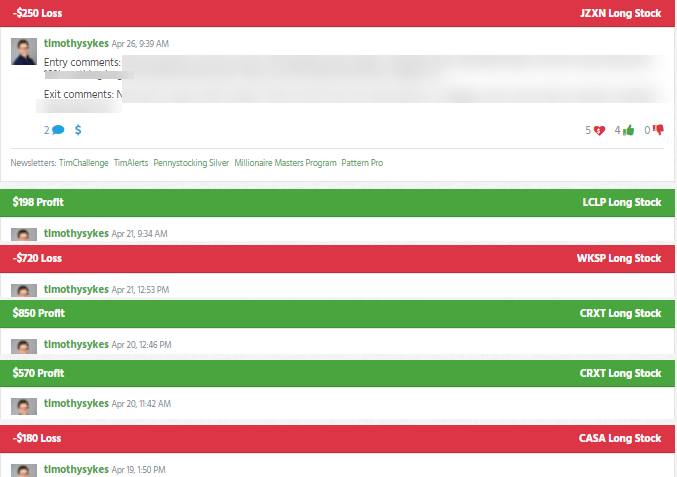

I want to use Jiuzi Holdings Inc. (JZXN) to illustrate this point.

No, this stock didn’t turn out to be a winner.

But check this out…

My winners outweighed my losers!

There isn’t some secret formula that creates this kind of outcome. It’s basic math.

It all boils down to how three elements relate to one another.

Here’s what I mean.

Framing Your Setup

Every single trade starts with a setup.

And every setup has three elements:

- Entry

- Profit target

- Stop loss

You should be able to tell me each of these BEFORE you enter a trade.

That sounds simple. I agree.

So, here’s the second step.

You need to define how these relate to each other.

Think of a coin flip.

You have a 50% chance of getting heads or tails.

If I bet you $1 to make or lose $1 for every flip, over time, I’d break even.

Sure, we could see a run of wins or losses. But flip the coin and make this bet enough, I’d break even.

Now, imagine I bought a stock at $1 per share. It has a 50% chance of hitting $1.10 and a 50% chance of hitting $0.90.

Same as the coin flip, if I reproduced this trade over and over, I’d break even.

But what would happen if instead of buying at $1.00 I entered the trade at $0.99?

Assuming I still had a 50/50 shot at the profit and loss level, over time, I would make money. It wouldn’t be much, but it would be a profitable venture.

You see, traders can make money one of two ways (and everywhere in between):

- A high win rate with small wins that outweigh the big losses

- A low win rate with huge wins that outweigh the small losses

Your ability to make money over time is based on a concept known as expected value.

Expected value (EV) is the amount you expect to make or lose over time given enough trades that occur under the same conditions.

It boils down to your risk and your win-rate.

Here’s the formula:

EV = (% Chance of Win x Potential Profit) – (% Chance of Loss x Potential Loss)

Let’s go back to the example where I bought a stock at $0.99 and had a 50/50 shot it would get to $0.90 or $1.10.

Here’s the expected value:

EV = (50% x $0.11) – (50% x $0.09) = $0.055 – $0.045 = $0.01

Now, here’s the cool part.

Assuming your probability of success doesn’t change, a lower entry creates a multiplier effect on your expected value.

Going back to our example, let’s now assume you can get $0.98 for your entry.

What’s a penny matter right?

In this case quite a bit.

EV = (50% x $0.12) – (50% x $0.08) = $0.06 – $0.04 = $0.02

You’ve doubled your expected value!

Why?

Because you gained more potential profits WHILE reducing your potential loss.

And this is the key when I talk about losing small.

I want setups with fantastic entries that give me tiny losses and massive potential profits. That way, I don’t need to win all that often. Just enough to make it rain.

Application – $JZXN

Let’s step into a chart of JXZN.

Thanks to our Breaking News Team, I picked up on this stock as it got a boost in the premarket.

From there, shares consolidated around $2.40 before dropping down to around $1.75.

I want you to notice the support right around $1.75.

We didn’t know that the stock was going to stop there.

But, we had some clues.

If you look to the left, that was the spot where price spent a brief, and I do mean brief, minute or so consolidating before taking the next leg higher.

Now, I’m not saying that’s where I want to buy.

However, once that shows me the support level, I have my stop loss area to trade against.

From there, I want to identify all the potential scenarios the stock could take.

As the market opened, shares briefly spiked that price before starting a run higher.

That to me signaled the support would hold and the stock could make a run for the recent highs around $2.35-$2.40.

I fully admit I didn’t get the greatest entries here at $2.04.

But, let’s look at the math.

If my stop was $1.75 (which in reality I cut at $1.99), and my target was $2.35, with an entry of $2.04, I can actually calculate the win-rate I would need to breakeven…which is 48.3%.

That’s not great. But like I said, I didn’t get the entry I should have.

Now, what would this trade have looked like had I gotten what I set out in my video review?

My ideal entry was closer to $1.90.

Guess what win-rate I would need to breakeven with that entry?

25%.

Do you think with some practice, you could win a trade like this more than 1 out of 4 times?

That’s what I want you to find out.

Do yourself a favor. Check out my SuperNova program and where you learn all you need to identify and trade these amazing setups.

Click here to learn more about SuperNova.

— Tim

The post Define Your Trade – $JZXN appeared first on Timothy Sykes.