The stock market is closed today in observance of Washington’s Birthday.

Most of us just call it President’s Day. Does it matter whether it’s President’s Day or Washington’s Birthday?

It might seem strange to split hairs over details, but it brings up an important lesson…

In trading, details matter.

For example, take my recent $460 win on Nitches, Inc. (OTCPK: NICH).

The details — specifically what I saw on Level 2 — kept me in the trade when I’d normally get out.

Reading Level 2 is one of the key skills you need to master. Especially for trading OTCs.

First, let me explain the NICH setup. Then I’ll explain how I used level 2 to manage the trade…

NICH: the Setup

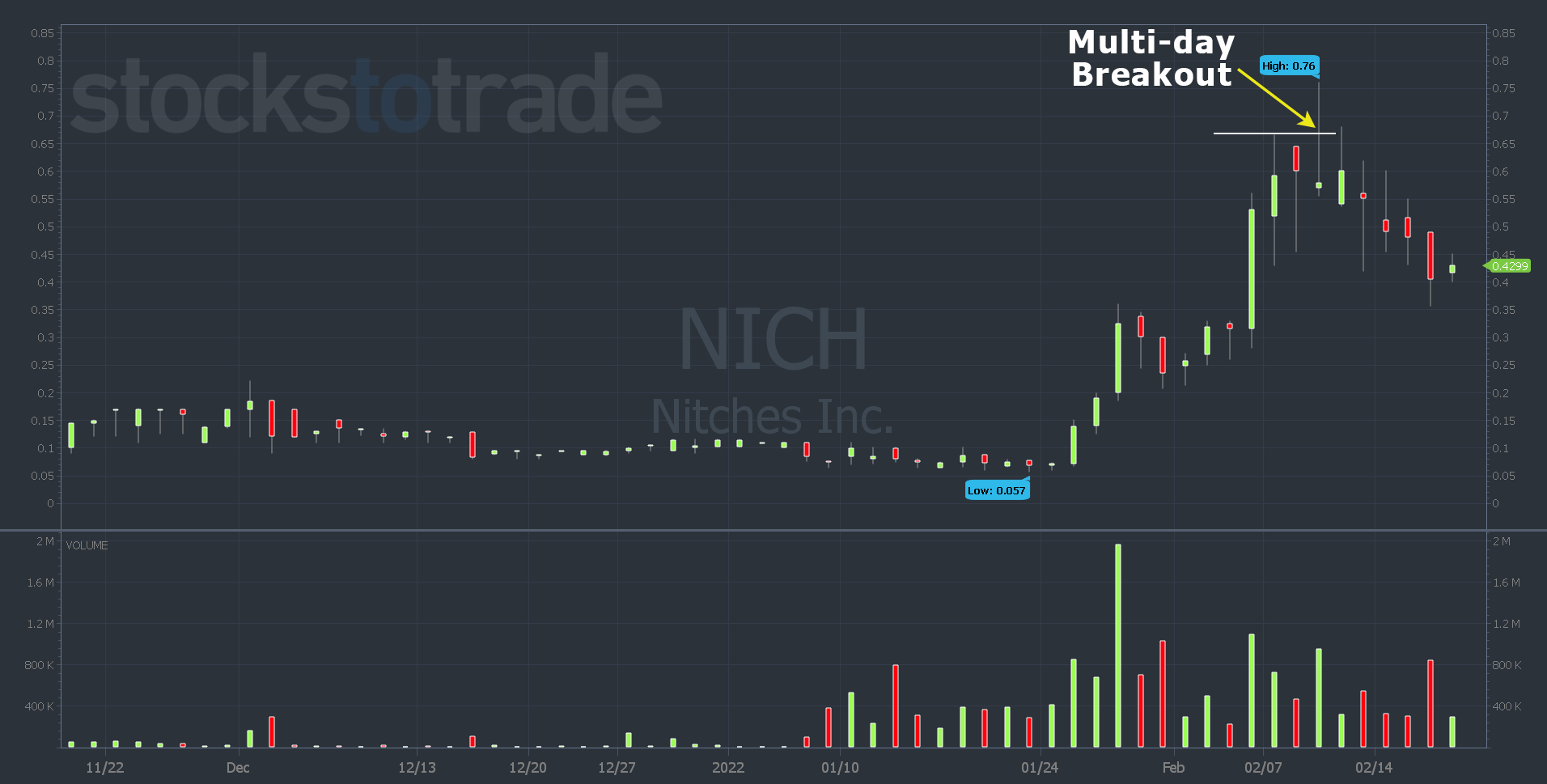

On February 9, NICH was a multi-day runner with a multi-day breakout…

As you can see, NICH ran for three days in January before consolidating for five days. Then it spiked again, hitting a high of 66.7 cents per share on February 7.

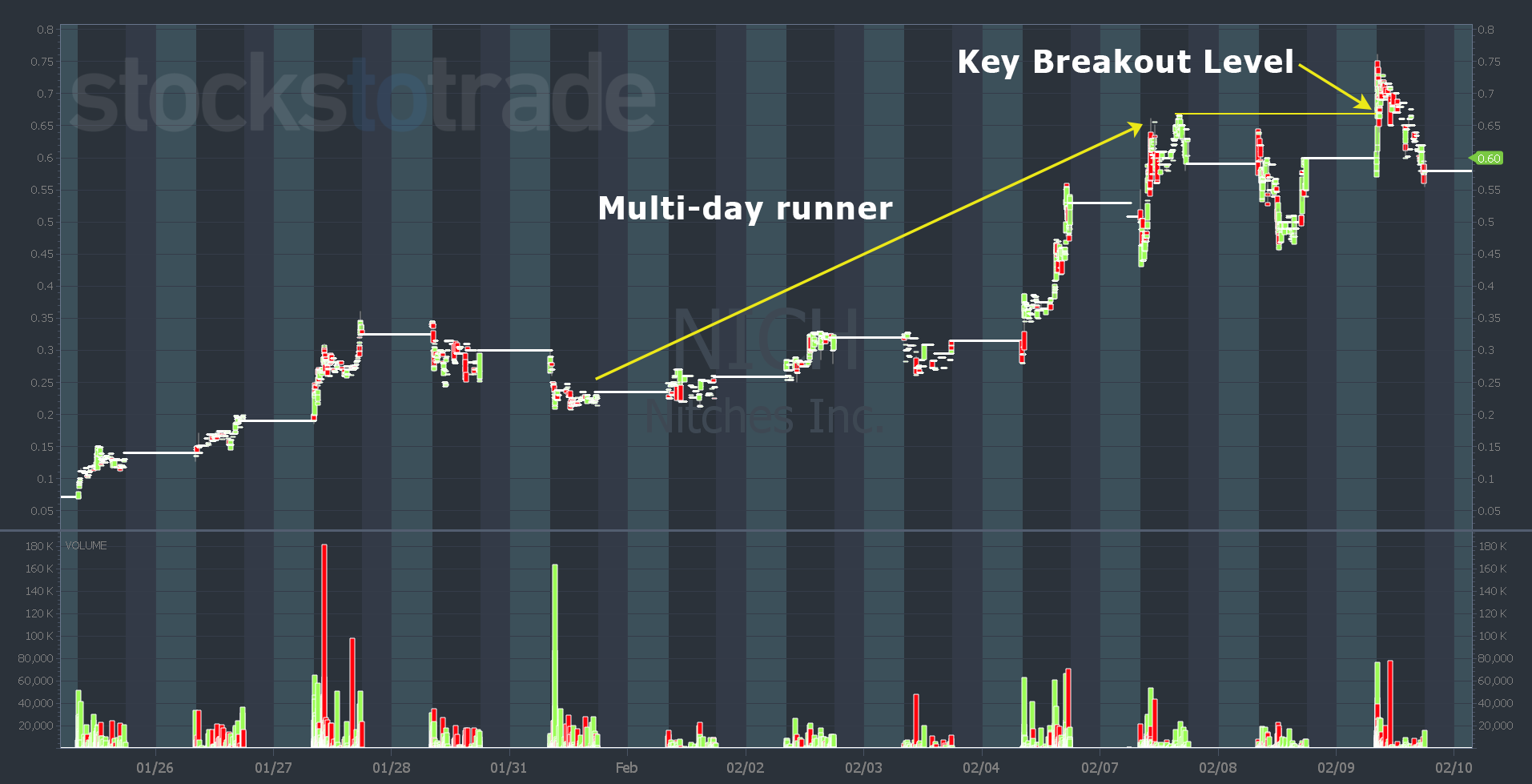

Now check out the multi-day chart showing the breakout level at 66.7 cents per share…

The breakout level was key to how I used Level 2 to manage the trade. Keep it in mind as you study the February 9 intraday chart with my trade entries and exit…

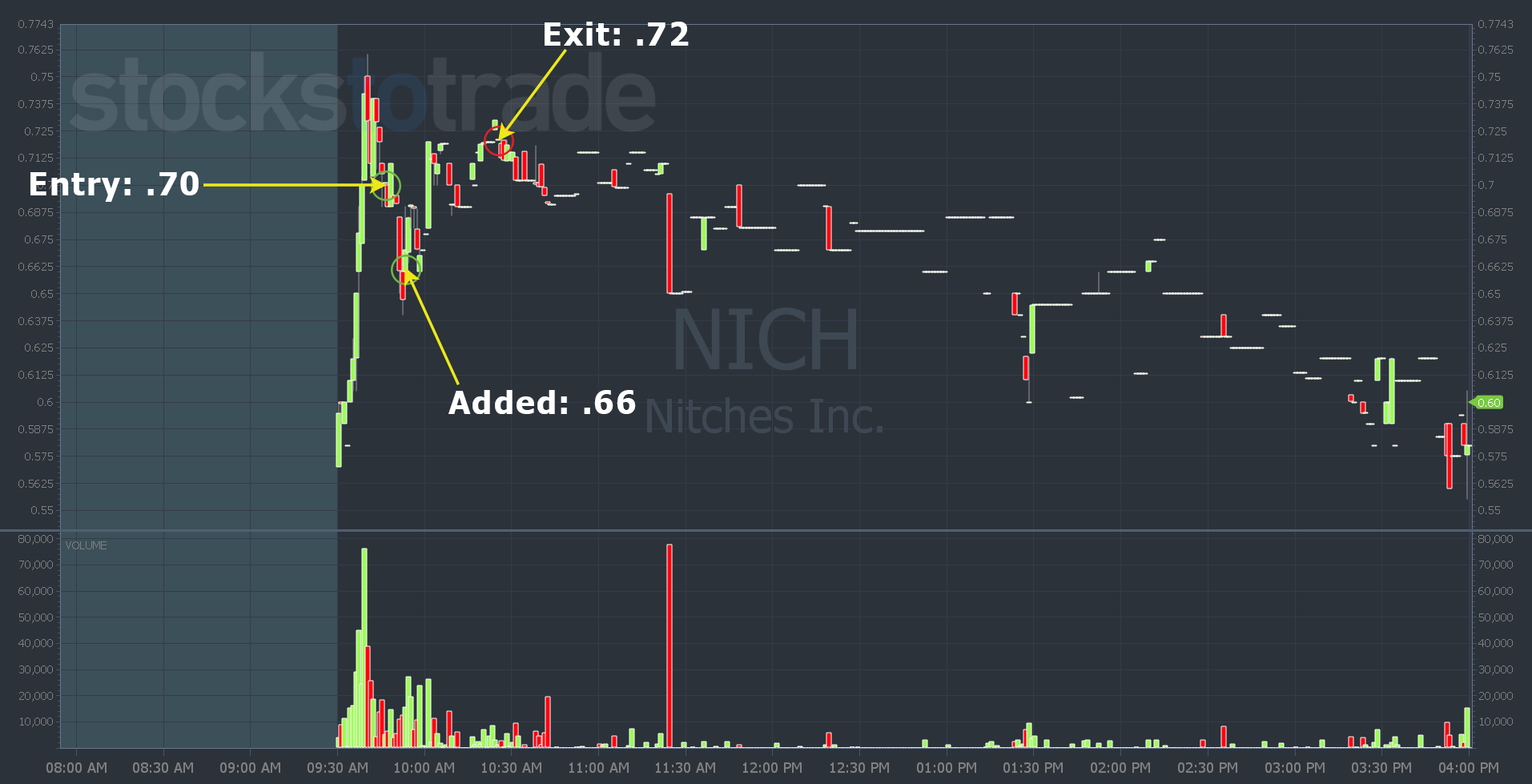

As you can see, I bought the dip off the morning spike. It’s one of my standard setups when I think a stock can keep running. Here’s my entry comment…

02/09 9:40:25 AM — Bought 6500 shares $NICH at 0.7 — Partial fill on this big spiker breaking out of recent range, small position due to less liquidity and it’s over-extended but let’s see how far this can go, cut losses if no further spiking.

I would have loved to get this at a lower price. But it was moving fast and I didn’t want to chase so I bought the dip. Then I adapted based on what I saw on Level 2…

How to Use Level 2 Data to Manage a Position

First, I added to my position even though my entry comment said “cut losses if no further spiking.”

Then, I held it for another 30 minutes. If you follow my trades you know that I have the patience of a gnat. Holding an overextended penny stock for 30 minutes isn’t my normal MO.

Remember, the multiday breakout was at 66.7 cents. I added to my position at 66 cents. That got my average down to roughly 68 cents per share — more in line with where I wish I’d got into the trade in the first place.

Why did I do it?

When it dipped a little below 66 cents on light volume, I didn’t think it was bad. I actually tried to get shares below 66 cents. And when it came right back, it held the multi-day breakout level.

But what really gave me confidence was a big bidder.

Level 2 showed a 63K share bidder at 66 cents per share. The bidder first showed up at 66 cents, then 67, 68, and as high as 69.5 cents — driving up the price.

NICH Trade Thesis

My original thesis was that NICH could get to the high .70s or .80s. At best, I thought it might get to 90 cents a share when it was spiking and eating through the ask. I recognized it as one of the biggest recent runners and thought “let’s see how far this can go…”

The daily volume was less than a million, so that 63K bidder was a big order. If somebody wants to buy it that badly, they’re usually willing to pay a little more. I wanted the bidder to keep pushing it up.

So I watched, hoping it would break out over the morning high. At first it headed in the right direction. But when it got to 71 or 72 cents, there was a wall of sellers.

That’s when I realized it wasn’t likely to get past the high of day. So I got out for a small win. It didn’t meet my goals, but I played the action instead of holding and hoping.

If there hadn’t been a 63K bidder, I would’ve cut it and lost $100 or $200. So one indicator, which to me was a strong indicator in the form of a big buyer, gave me the patience to hold.

That’s a good lesson but there’s more to it. Let’s flip the script…

What About Big Sellers?

What if there had been a 63K seller near the open? I would’ve gotten out almost immediately. A big seller would block any potential for a big spike. I used the 63K bidder as a crutch to give me more time and patience.

But if there was a big seller it wouldn’t be worth the risk. Why? Because the stock was up from six cents in a couple of weeks. That’s a big move and it got overextended.

I used all the indicators and my experience. My first entry wasn’t ideal but my second entry was right at the key multi-day breakout. And I got help from a mysterious big buyer who turned out to be wrong.

My NICH trade is only one example of how I use Level 2 to manage a trade. There are nuances that come with experience.

Speaking of experience…

On February 22 at 8 PM ET, I’m sitting down with trading legend Chuck Hughes. Chuck has finally agreed to share the power of his “snowballing” strategy on camera. It has nothing to do with penny stocks, but I’m super excited.

In this market, it’s good to learn new strategies…

Click here to register for the FREE “7-Day Snowball Trading Summit”

See you there.

Want more in-depth trade reviews featuring details like why it’s important to use Level 2? Comment below, I love to hear from all my readers!

The post Why Use Level 2 to Manage a Trade? appeared first on Timothy Sykes.