“A gape” is an ancient Greek word usually defined as unconditional love, which is to give without expecting to receive anything in return. Despite having this world full of love, sometimes there are things that need reciprocity. An example is the contract of sale, which, according to the Civil Code, consists of contracting parties in which one obligates himself to transfer ownership and deliver a determinate thing and the other to pay a price certain in money or equivalent. This means that the seller shall give something to the buyer and expect to receive payment from the latter. For value-added tax (VAT) purposes, what would happen if the other one failed to compensate?

Generally, VAT-registered persons subject their sales to VAT. The next question is, when should the sales be subject to VAT? Republic Act No. 11976, also known as the Ease of Paying Taxes (EoPT) Act, adopted the accrual basis for VAT recognition for both the sale of goods and services. Hence, sellers of goods and services are required to remit VAT regardless of whether the amount has already been collected from the buyer or not. With that, there is a possibility that the sellers will be shouldering VAT for sales that may be uncollectible.

OUTPUT VAT CREDIT ON UNCOLLECTED RECEIVABLES

To address this concern, the EoPT Act also introduced the Output VAT credit on uncollected receivables, which was implemented upon the effectivity of Revenue Regulations (RR) No. 3-2024 in April 2024. This will allow sellers of goods and services who previously remitted the VAT on sales that were not yet collected after the lapse of the credit term to use the VAT paid as credit for the Output VAT reported in the next quarter after the lapse of the said credit term.

To ensure that the sellers are entitled to VAT credit, all of the following must be observed pursuant to RR No. 3-2024, which was clarified under Revenue Memorandum Circular (RMC) No. 65-2024 issued on June 13, 2024:

1. The sale has been made after the effectivity of RR No. 3-2024, or April 27, 2024;

2. Both parties agreed that the buyer will pay at a certain period and that the credit term is indicated on the invoice or any written document;

3. The VAT is separately shown on the invoice and declared in the quarterly VAT return within the period prescribed under existing rules;

4. The buyer is separately identified in the Summary List of Sales during the quarter when the sale was made and not reported under “various” sales;

5. The credit term, whether extended or not, has already lapsed; and

6. The VAT component of the uncollected receivable was not claimed as deductible bad debts for income tax purposes.

SELLER’S PERSPECTIVE

Once the entitlement has already been established, the seller may claim the VAT credit in the next quarter after the lapse of the credit term. Suppose that the lapse of the credit term falls on the quarter ending Sept. 30, 2024. The VAT credit is allowed to be claimed in the quarter ending Dec. 31, 2024. The seller is required, however, to stamp “Claimed Output VAT Credit” on the seller’s copy of the related invoice.

In cases of partial collection, the amount collected, and the remaining uncollectible amount shall be separately indicated. The seller may, at its option, also issue a supplementary document such as a credit memo or credit note, provided that the phrase “Claimed Output VAT Credit” and the related invoice are indicated in such a document. Once the stamped invoice and supplementary documents, if any, are secured, the seller is required to provide a copy to the buyer, as they must also reverse the claimed Input VAT.

If the receivable was subsequently recovered after the claiming of the VAT credit, the corresponding VAT of the collected amount shall be declared in the VAT returns during the taxable quarter when the collection was made. Failure to report the said amount will subject the seller to a possible VAT deficiency and applicable penalties.

Moreover, the seller is required to stamp “Recovered” on the seller’s copy of the related invoice. In cases of partial recovery, the collection and remaining uncollectible amount shall be separately indicated. The seller may also issue a supplementary document, such as a debit memo or debit note, provided that the phrase “Recovery of Previously Reported Uncollected Receivable” and the related invoice are indicated in such a document. Once the stamped documents are secured, the seller is required to provide a copy to the buyer to claim the previously disallowed Input VAT.

Since there is a possibility of recovery of previously uncollected receivables, sellers may not necessarily claim the VAT credit if there is a high chance that the buyer pays the credit despite the lapse of the term. Provided that this availment is merely an option, sellers may consider first the likelihood of collectability to avoid the burden of claiming credit and subsequent reversal recovery.

However, failure to claim the Output VAT credit on the next quarter after the lapse of the credit term will no longer allow the seller to claim the same afterwards and can only demand the buyer to pay what is due or to return the sold goods to recover the output VAT shouldered due to such sales.

BUYER’S PERSPECTIVE

Upon receipt of the documents from the seller evidencing VAT credit, the buyer shall deduct the corresponding Input VAT previously claimed. However, despite the non-receipt of such documents, the buyer can voluntarily reverse the Input VAT in the quarterly VAT returns. Failure to deduct the said amount will subject the buyer to a possible VAT deficiency and applicable penalties.

Subsequently, if the buyer was able to pay, either fully or partially, after the seller’s availment of the VAT credit, the buyer may claim the previously disallowed Input VAT upon receipt of the documents evidencing recovery from the seller.

With the additional load brought by this scenario, the relationship between the two parties might be compromised. Hence, buyers shall consider their capacity to pay before entering into the agreement. In any case where the buyer may not be able to pay on time after what was agreed upon, the buyer may request a possible extension to fulfill the obligations, provided that it is indicated in the invoice or any document showing the extended credit term.

PRESENTATION TO THE VAT RETURNS

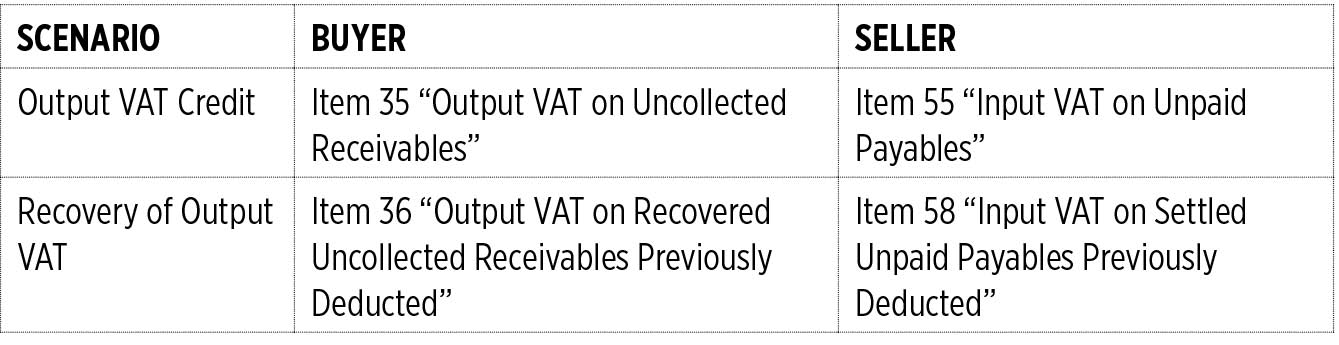

The BIR issued RMC No. 68-2024 on the availability of the revised Quarterly VAT returns (BIR Form No. 2550Q – April 2024 ENCS version), which include the following items to be used by the seller and buyer for the purpose of Output VAT credit. (see the table)

However, this version is not yet available in the Electronic Filing and Payments System (eFPS) and Electronic BIR Forms (eBIRForms). Accordingly, for eFPS and eBIRForms filers who are not required to report any amount related to Output VAT credit, they may still use the existing version of the return available in their respective systems.

Please note, however, that if eFPS and eBIRForms filers are required to report on any of the above items, they shall file the return manually by downloading and printing the revised return available on the BIR website (www.bir.gov.ph) under the BIR Forms — VAT/Percentage Tax Returns section and filling out all the applicable fields. If the return has a VAT payable, payment shall be made through any authorized agent bank (AAB) or with the Revenue Collection Officer (RCO) under any Revenue District Office (RDO).

Some eFPS and eBIRForms fillers, however, are hoping that the BIR will consider allowing them to just use the VAT return available in the system rather than manual filing, as online filing is more efficient and convenient.

TO GIVE CREDIT WHERE CREDIT IS DUE

Taxpayers may have a hard time dealing with these notable changes, coupled with several questions to ensure their compliance with tax matters. However, the government’s vision to ease paying taxes did not stop with just implementing the Act. With the BIR’s continuous efforts to address concerns raised by taxpayers with these revenue issuances, it is proper to give credit where credit is due.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Raymart F. Cinco is a senior in-charge of the Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.