Hey trader. Tim here.

I think Cathie Wood is a charlatan and a terrible investor.

There, I said it.

Her flagship fund — the ARK Innovation ETF (NYSEARCA: ARKK) — is down more than 66% year-to-date.

But her dismal performance isn’t the reason why I’m so down on her…

After all, if you stick around this game long enough, you’ll most likely have to deal with drawdowns.

The problem with Cathie, and a lot of the other talking heads, is that they can’t admit when they’re wrong.

And eventually, their stubbornness leads to portfolio destruction.

As I told my Trading Challenge students the other day, those folks who boasted about Netflix Inc. (NASDAQ: NFLX) being such a great company with incredible management…

…they need to shut up. The stock sucks.

Making these idiotic statements keeps people from accepting reality.

Over the past several months, I’ve prepared my students for the crash I called back in November.

And there was one crucial lesson that applies to both trading and investing that everyone needs to hear…

News vs. Hype

These days, it’s nearly impossible to differentiate between news and opinion, fact and fiction.

Traders struggle against the constant flood of misinformation and gaslighting.

What makes it worse is getting sucked so far into this mindset that real headlines seem doubtful.

That’s why hedge funds pay hundreds of thousands of dollars every year for exclusive access to curated news from Bloomberg Terminals and others.

I’m incredibly thankful that our StocksToTrade platform’s Breaking News team does the same thing for retail without breaking the bank.

Every morning, I check in with these guys to find out what’s moving the stocks that I want to trade.

Plus, they let me know when other popular chat rooms are potentially pumping a stock up.

Here’s a piece of news they dropped on Friday with some incredible results…

In the world of trading … Accurate, timely information is more important than ever.

It also takes practice and experience to recognize which headlines give stocks real momentum and which stories only offer fleeting gains.

Now, I’m gonna tell you something that might seem obvious…

Most penny stock news runs on hype.

Don’t get me wrong … When a pharmaceutical company announces the results of a trial, that’s legitimately good news.

But it isn’t in the same ballpark as actually selling the product.

Real News is Now

Cathie Wood bet a lot on future growth.

Then the Fed stepped in and started raising interest rates.

Now, the markets are telling her (and everyone else) that future growth isn’t as important as earnings are in this environment.

News that drives a stock for months (or years) is based on what’s happening at the moment.

That’s why good earnings can be a powerful catalyst for companies — one of my favorites to induce short-squeeze plays.

This same concept applies to long-term investments and large-cap companies.

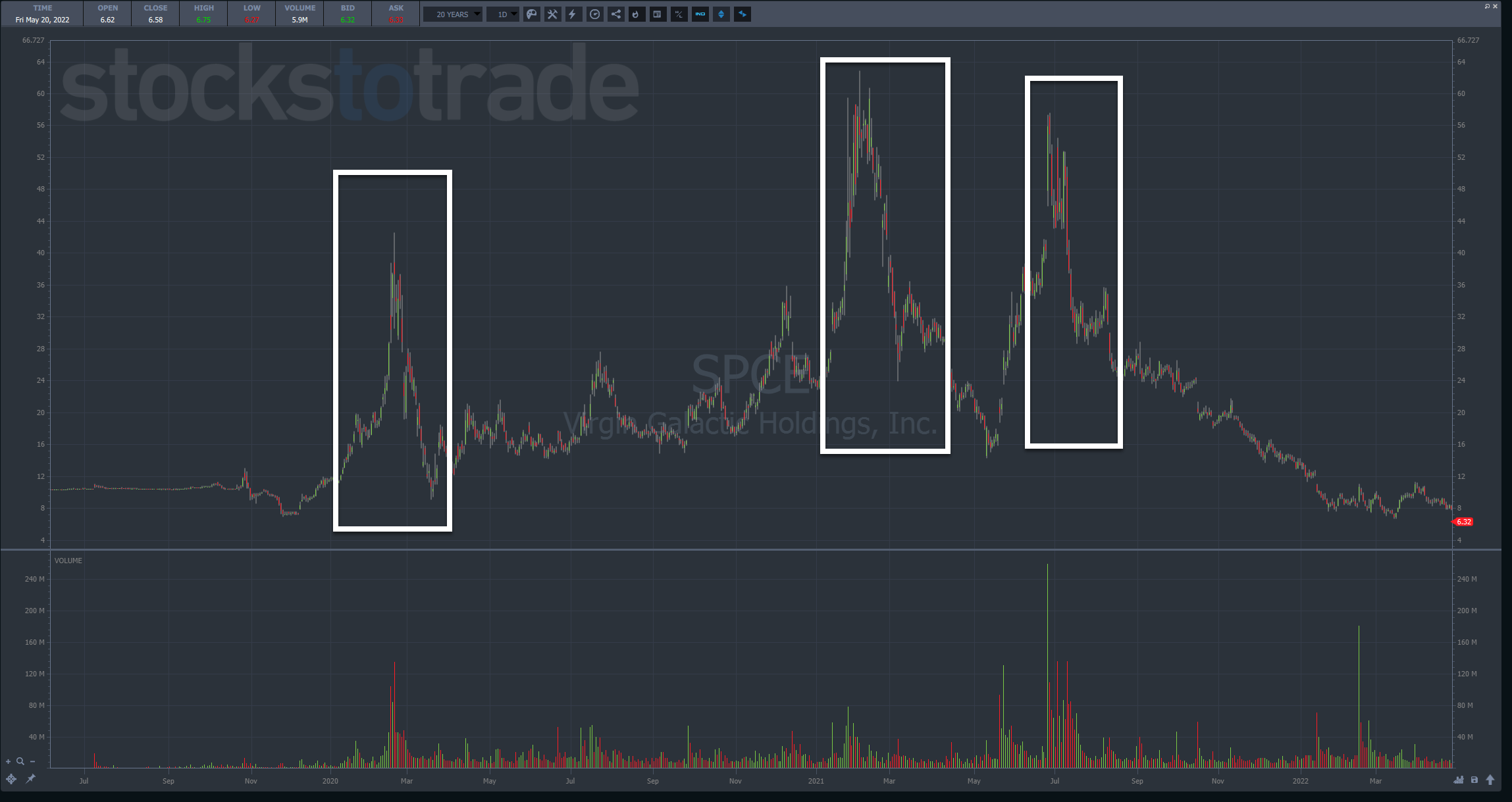

In fact, one of the best ways to identify a hyped-up stock is through my Supernova Pattern.

When I see a stock rise into the stratosphere, and the company doesn’t even generate positive cash flow, I know something is wrong.

Just look at a stock like Virgin Galactic (NASDAQ: SPCE)…

Is this stock tradeable?

Absolutely.

But it’s far from investible.

Yet, talking heads are still prancing around on financial networks talking about how cheap this stock is or that stock is.

A long time ago, I learned a valuable trading lesson — just because something is cheap doesn’t mean it can’t get cheaper.

The #1 Tell for Any Stock

Price action. Plain and simple.

If I want to know where a stock might be headed, I look at the price action before anything else.

That’s how I’ve been trading this market for the past several months.

If the economy is heading into the toilet, there probably won’t be a ton of great news coming.

That said, there are still plenty of trades out there.

When I use price action to find setups — such as a breakout above the highs on a low-float stock, or the morning panic — I don’t have to worry about what’s going on in the broader market.

I simply focus on the trade at hand, which can (and often does) move independently of the overall market, especially if I’m trading penny stocks.

Final Thoughts

Headlines about a hedge fund’s market outlook, or some shmo on television talking about their latest themed investment, aren’t what I care about.

When I trade, I want two things: solid price action and real news.

Using the news means looking at the facts of what’s being reported.

I want to see tangible statements about an activity.

That’s what counts in this market.

—Tim

The post Don’t Let Them Sell You Snake Oil appeared first on Timothy Sykes.