Hey trader. Tim here.

It’s been almost 30 years since my parents let me take $10,000 in Bar Mitzvah money to jump-start my trading career.

I didn’t become a millionaire overnight. Not by a long stretch.

In fact, the market beat me up plenty as I clawed my way to the top.

Today, I’m still amazed to look at all of the things I’ve achieved from that small account.

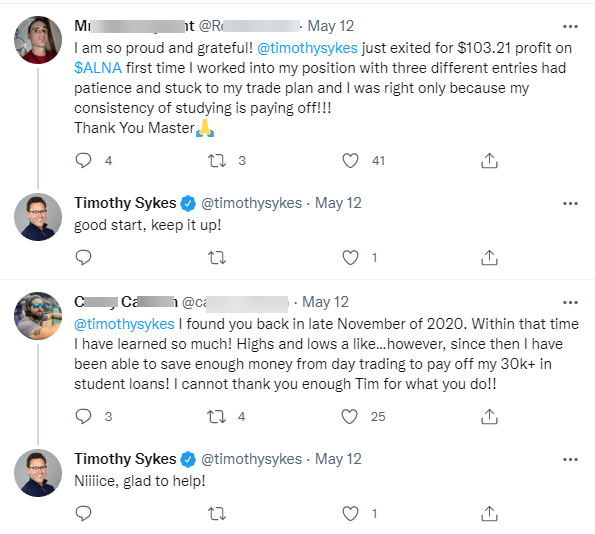

When I began my mentorship program, I wanted my students to reach those same heights.

And This Friday’s LIVE Mastery Class takes that to a whole new level!

But I knew that wouldn’t happen unless I could teach them how to take a small account and turn it into a wealth-generating machine.

Over the years I created small account challenges for myself — comparing the trades, strategies, and risk management to larger accounts.

It turns out they’re more alike than you might think.

Plus, one of the biggest drawbacks, the pattern day trading restriction (PDT) can actually be an advantage.

But I don’t want anyone to think that it’s easy to take $100 and turn it into $1 million.

However, ANYONE can break through the market to become a successful trader, even folks with small accounts.

For years, high broker commissions and fees ate away at my profits.

But now that equities mostly trade commission-free, there are only a few things I need to successfully grow a small account.

Make Friends with the PDT Rule

By far, the number one complaint I hear with small accounts is the limitation imposed by the pattern day trading rule (PDT).

Let me explain for those not familiar with this rule. After the advent of online trading in the late ‘90s and the bubble bonanza with dot-com stocks, the SEC implemented the PDT rule in February 2001.

The rule says that margin accounts containing less than $25,000 could only take three round-trip trades within five business days.

You can learn more about the specifics from my recent blog post.

In that article, I touch on the idea I’m about to tell you…

Stick with three round-trip trades per week.

Don’t try to game the system or find a loophole through an offshore broker.

Just stay with the three trades per week restriction.

One of the most common mistakes any trader makes is overtrading.

We get a hot hand, revenge trade, or simply get caught up in the momentum. Ultimately, we enter less-than-ideal setups (or take on too much risk).

Imagine if I laid out 50 trades for you to choose from each week. If you could only pick three, which would you choose?

For my money, I’d go for setups with higher probability — or a nice risk/reward ratio — to help grow my account faster.

When I limit myself to only a few trades, I instantly zero in on the best ones out there. That doesn’t mean they work every time. But I can say with full confidence that I’m giving myself the best shot at success.

Treat It the Same as a Large Account

If you can’t make money with a $5,000 account … you have no business trading a $50,000 account.

It’s that simple.

I don’t look at risk and reward in total dollar terms. Instead, I view it as a percentage of the account.

Here’s an example…

Let’s say I take a trade where I risk 2% of my total account value to make 5%.

For a $5,000 account, that means I could lose $100. For a $50,000 account, I could lose $1,000.

The dollar amount isn’t important. What matters is the percentage of my account that I put on the line.

Penny stock trading isn’t like buying and selling Alphabet Inc. (NASDAQ: GOOG) or Amazon.com, Inc. (NASDAQ: AMZN), where you might only be able to buy one or two shares.

With penny stocks, you can potentially buy hundreds of shares, giving you the flexibility to scale in and out of the position.

This brings me to my final point…

Take Many Small Trades

You never want any single trade to blow up your account.

I constantly tell my students to take small, fast losses.

Over the years, I watched far too many traders get cocky and push their chips in … only to watch the trade decimate their P&L.

Most successful traders earn their profits over the long haul.

Only a few make large, well-timed bets. Good for them … but that’s not something I can teach.

I want my students to create consistent streams of income through trading.

And the only way to do that is with a repeatable, mechanical process.

Trading should become so ingrained that the actions become second nature.

Sure, you might make a few trades each year that pay out HUGE. That’s actually pretty common.

But make sure that when you trade with a small account (same as a large one), you give yourself space so that no one trade (or string of trades) can break you.

With that in mind, I’d like to invite you to come check out one of my absolute favorite patterns for small account traders.

This is the same pattern I used to help me turn that $10,000 account into more than $7 million.

Click here to learn more about my Supernova Pattern.

—Tim

The post The Smart Way to Grow Your Small Account appeared first on Timothy Sykes.