For two years during the pandemic, many of us worked from the comfort of our homes, enjoying the benefits of the work-from-home (WFH) arrangement and avoiding traffic and reducing transportation costs. However, this will come to an end for those working for Registered Business Enterprises (RBEs) of the Information Technology – Business Process Management (IT-BPM) sector, which started to return to office work on April 1.

Section 309 of the Tax Code requires that RBEs in economic zones or freeports be exclusively conducted or operated within the geographical boundaries of the zone or freeport. Any project or activity conducted or performed outside of the geographical boundaries of the zone or freeport is not entitled to incentives.

In relation to this, the Fiscal Incentives Review Board (FIRB) issued Resolution Nos. 19-21 and 23-21 that allowed RBEs IT-BPM to continue the WFH arrangement only until March 31, 2022, without compromising their fiscal incentives. The conditions to enjoy the WFH were as follows:

1. The number of employees under the WFH arrangement shall not exceed 90% of the total workforce that are directly and indirectly engaged in registered activity of the RBE and shall exclude third-party contractors.

2. The number of laptops and other equipment of an RBE outside the ecozone shall not exceed the number of its employees who are under WFH arrangement.

3. Bonds shall be posted for all the equipment deployed to ensure payment of taxes and duties, if any.

4. Revenues from exports shall be maintained regardless of the allowed ratio of employees who will work from home. Provided, that the current number of employees shall not be reduced even if the majority of their employees are working from home.

5. The RBE shall comply with the reportorial requirements and site inspection.

Noncompliance with the above conditions is considered a violation leading to suspension of the income tax incentive for the period of noncompliance. The RBE in the IT-BPM sector would be liable for a penalty equivalent to income tax using the regular rate of 20% or 25% during the months that it committed such a violation.

FIRB Resolution No. 006-22 clarified that the penalty for noncompliance with the provisions found in FIRB Resolution No. 19-21 will be effective from Sept. 13, 2021 until the expiration of the effectivity of FIRB Resolution No. 19-21 on March 31.

COMPUTATION OF PENALTY

Per BIR RMC No. 39-2022, the noncomplying RBEs in the IT-BPM sector are to continue to file their annual income tax return (AITR) using BIR Form No. 1702 EX for those with the Income Tax Holiday (ITH) incentive and BIR Form No. 1702-MX for those enjoying gross income tax (GIT) incentives with mixed transactions.

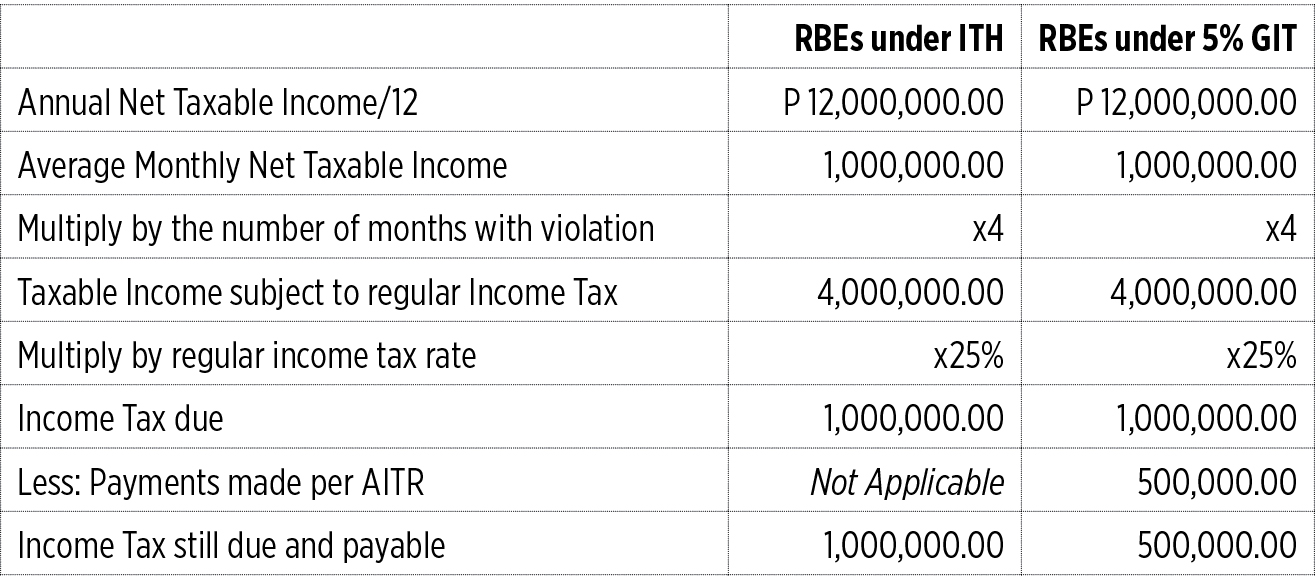

However, they are subject to additional penalties for the months during which they were not compliant with the FIRB conditions. Assuming that the RBE was not compliant between September and December 2021, the computation of penalty is illustrated as follows:

As discussed above, RBEs are to first file and pay based on the incentives that they enjoy. Thereafter, they are to compute the penalties equivalent to the regular income tax of 25% or 20% for the months they were not compliant. In the example above, the RBE enjoying ITH did not pay income tax for the whole year while the RBE enjoying GIT paid the 5% tax of P1.5 million for the entire year.

Considering that the violations occurred for four months, the regular corporate income tax is computed for the four months. Hence, the regular corporate income tax due is arrived at by computing for the entire year tax and then dividing by 12 months. The result is to be multiplied by the number of months that the RBE IT-BPM was in violation. In the illustration above, the RBE is subject to the regular corporate income tax of 25% computed at P1 million for the noncompliant four months.

Once the regular income tax due is computed, the prior payments made using the incentives are to be deducted and only the remaining tax will be due. In the case illustrated above, since the RBE did not pay income tax under the ITH scenario, the entire P1 million becomes payable. However, for the RBE enjoying 5% GIT, since it already paid P500,000 for the four months when it filed its AITR, only the remaining P500,000 is due when it pays the penalty.

MANNER OF FILING AND PAYMENT OF PENALTY

RMC 39-2022 stipulates the uniform use of BIR Form 0605 for the payment of penalties.

The RBE IT-BPM voluntarily paying the penalty is to indicate in the BIR Form 0605 ‘Others’ under ‘Voluntary Payment’ the phrase ‘Penalty pursuant to FIRB Res. No. 19-2021.’ The tax type code remains ‘IT’ and ATC is ‘MC 200.’

The payment is due within 30 days after the due date prescribed for the payment of income tax. Should the payment of penalties be made beyond the prescribed period, administrative penalties are to be imposed. The RBE IT-BPM may opt to voluntarily pay the penalties using the prescribed computation and manner of filing and payment discussed above. The voluntary payment of penalties for the violation of the WFH limit and the conditions set forth above are not an absolute guarantee that the RBE will not be subject of a BIR assessment. The benefit of paying voluntarily is that the voluntary payment made may be directly credited and deducted against the assessed deficiency taxes.

MOVING FORWARD

The illustration provided by the BIR covered the annual income tax filing for the affected RBE in the IT BPM sector for calendar year 2021.

However, as the first quarterly income tax return for 2022 is nearing, RBE IT-BPMs are now in a quandary on how to pay and file their first quarter return. Are they supposed to follow the prescribed procedure set forth in the RMCs? Will these RBEs be computing income tax payable using the regular rate if they were not compliant in the first quarter of 2022? Or will they continue to pay their quarterly income tax based on their incentive and pay the penalties in April 2023? Since the RMC is silent as to quarterly filings, is the computation of penalty done during annual preparation only?

The RMCs is also silent as to the suspension of other fiscal incentives available to IT-BPM RBEs. The FIRB resolutions specifically mention suspensions of their ‘fiscal incentive.’ However, the RMCs limit their discussion as to penalties relative to income tax incentives. Can we assume that the violation of the WFH conditions will not affect the VAT zero-rating of local purchases of these RBEs for as long as they keep their registration as registered export enterprises?

Is the prescribed computation of penalty already in lieu of other taxes that may arise in case of non-compliance? Since the RBE became subject to the regular corporate income tax for the noncompliant months, will the local business tax be also payable for the affected months? Take note that the 5% GIT already included the 2% tax due to the local government. Since the 2% tax is already paid to the local government, further payment is arguably no longer due even with the violation of the WHF. However, for those under ITH, there was no local business tax paid. Hence, will they now be subject to local business tax for the period that they become subject to regular corporate income tax.

If the RBE ITM BPM remains noncompliant after March 31, what penalties will be due? How will it affect the non-income tax incentives that they are enjoying?

For the affected RBEs, uncertainties still abound and further clarifications from the regulators would be most welcome to allow them to plan and strategize moving forward as they all strive to return to the new normal.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Marie Abigail C. Geluz is a senior in charge from the Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.