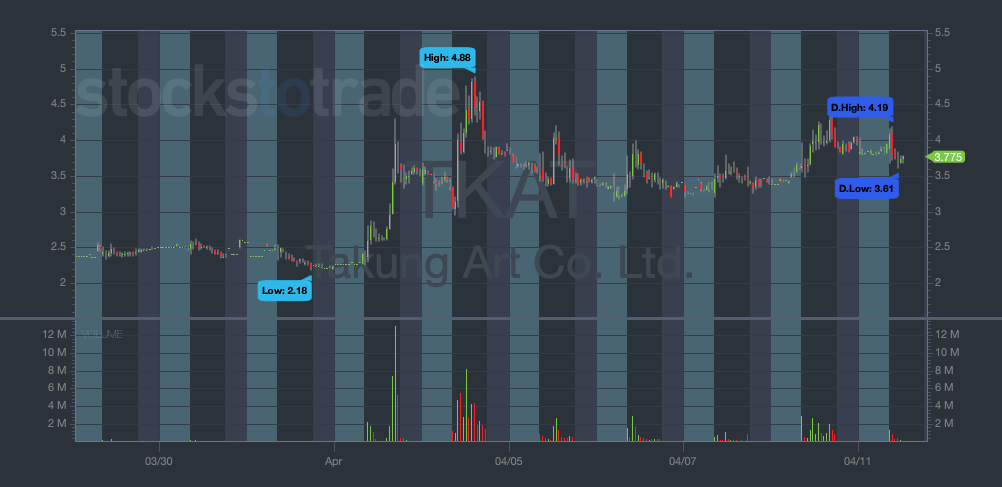

Stocks in the NFT sector have been volatile lately — just look at Takung Art Co Ltd. (NYSEAMERICAN: TKAT). A couple of weeks ago it was trading in the low $2s. Early this month, it nearly hit $5. As I write this, it’s back in the $3s.

NFTs are hot. NFT stocks are hot. But you can still lose if you choose the wrong plays — or if you hold too long.

- I don’t want you to lose.

- I want you to choose the right plays.

- And I want you to know when to take profits.

That’s why today I’ll share some crucial lessons with you about how I’m profiting and staying safe in this hot sector.

These lessons come from my recent Trading Challenge webinar. (Miss the webinar? Trading Challenge students can watch the replay here. Keep reading for a taste of what you’ll learn when you watch the replay.)

Want access to my webinars? Apply to my Trading Challenge today. It’s the ultimate educational resource for traders who are serious about taking their careers to the next level.

Meantime, follow these three vital rules to stay safe in this high-potential sector…

NFT Stock Rule #1: Don’t Forget To Take Profits

Last Friday morning, I had a $315 profit on TKAT. I’m really happy with this trade, even though I could have made a LOT more.

When I saw this NFT play was showing signs of spiking, I was prepared (keep reading to learn how). I entered at $3.70 with a goal of selling in the $4s.

But then I saw a wall of sellers in the $3.80s. I warned my followers that it looked ‘toppy’ and I took profits.

There’s a reason why. TKAT has followed a pattern lately — it spikes up fast then tops and comes down quickly.

Or as I put it in this tweet…

https://t.co/O6MEVxonGj NFT plays are choppy AF

— Timothy Sykes (@timothysykes) April 8, 2022

I didn’t want to get caught. I sold at $3.77. Sure, I could have made a little more per share on that morning spike. But I don’t care that I missed the top — I stayed safe and made a profit.

https://t.co/O6MEVxonGj Speculative Friday morning spiker with a solid history…

— Timothy Sykes (@timothysykes) April 8, 2022

Stocks have personalities and characteristics — and they tend to perform the same way over and over. Which brings me to my next point…

NFT Stock Rule #2: Study the Past

Another way I stay safe with NFTs is with my ‘retired trader’ mindset. (I’m sure my students are tired of hearing about it.) The idea is that a trade has to be so good it takes me out of my self-imposed ‘retirement’ to take a position.

I know it’s weird, but it helps me to be discerning and stay safe.

How do I know a trade is good enough? One key way is that I study the past. Stocks that ran in the past tend to run again.

Just look at two NFT plays I traded last week — DatChat Inc. (NASDAQ: DATS) and Dolphin Entertainment Inc. (NASDAQ: DLPN).

Have a great weekend everyone, but remember to study haaaaaaaard! I had a decent little +$4k week thanks to being prepared for the #NFT plays spiking today like $TKAT $DATS $DLPN so study https://t.co/5na3WlzftH & https://t.co/KszAsxTvmc so you can participate in sector rallies!

— Timothy Sykes (@timothysykes) April 1, 2022

I knew that both stocks had potential because they both had monster runs back in 2021 when NFTs first got hot. I knew what they were capable of.

Also, I knew that there had recently been a BIG catalyst for NFTs. After OpenSea announced they’d be taking credit card/Apple Pay, a bunch of NFT stocks started running.

TKAT, the sector leader, was running.

So I knew that other NFT plays could follow, and I was willing to come out of retirement and make some trades.

I studied the past and saw the catalyst. I was prepared.

The result? I ended up having two small wins — a $150 profit on DATS and a $1,410 profit on DLPN.

I want you to study these trades. I want you to look at what both of these stocks do when there’s news. That way, next time you see a catalyst in this sector, you can be prepared to react.

A lot of people ask me how I find runners like this. That’s easy — StocksToTrade’s Breaking News Chat alerts are my TOP resource for finding catalysts that have stock-moving potential.

NFT Stock Rule #3: Learn Everything You Can

As a trader, you have two accounts — your brokerage account and your knowledge account.

It’s easy to lose all your money if you don’t know what you’re doing.

That’s why you must focus on filling that knowledge account first if you want to stay safe.

That means learning everything you can about NFTs. I’ve written several posts on NFTs lately — here are just a few:

- NFTs And Trading Penny Stock Online Beginners Tips: Blockchain Basics & Beyond

- NFT Checklist: Here’s What You Need to Trade

- How to Spot an NFT Scam

- Crypto Wallets & NFTs: What Traders MUST Know

- Can Trading Penny Stocks Give You an Edge Trading NFTs?

- Matthew Monaco Hijack! How the Boy Wonder Is Crushing NFT Trading

I believe that NFTs are creating some of the best opportunities for traders right now. That includes both NFTs and NFT-related stocks.

No matter which side you want to trade on, if you want to capitalize on this market, you MUST understand it.

That’s why I collaborated with my student Adam to create the ultimate NFT resource — the Tim Sykes NFT Club. Adam has made over $1 million trading NFTs — he knows what he’s doing. If you’re interested in trading NFTs, this resource can help you get started the right way.

Do You Get It?

I want you to be able to capitalize on the opportunities NFTs are creating for traders. But I also want you to stay safe.

The market’s choppy right now — it’s easy to lose money if you don’t know what you’re doing and don’t put safety precautions in place.

If you want a more detailed take on my trades and access to several webinars per week, apply for my Trading Challenge today. I don’t take just anyone — I only want students who understand lessons like this and who want to stay safe.

How well do you understand the lessons I shared in this post? Let me know you get why it’s essential to be prepared when the market’s choppy — leave a comment below!

The post Challenge Webinar Top Penny Stock Trading Lessons: 3 Vital Rules For Trading Choppy NFT Stocks appeared first on Timothy Sykes.