The Federal Reserve has its hands tied and finally announced it will be increasing rates due to the incredible increase in inflation under the Biden regime.

Yesterday the Fed reported that it will finally increase interest rates but probably not till March 2022.

The Federal Reserve signaled Wednesday that it plans to begin raising its benchmark interest rate as soon as March, a key step in reversing its pandemic-era low-rate policies that have fueled hiring and growth but also escalated inflation.

With high inflation squeezing consumers and businesses and unemployment falling steadily, the Fed also said it would phase out its monthly bond purchases, which have been intended to lower longer-term rates, in March.

The Fed’s actions are sure to make a wide range of borrowing — from mortgages and credit cards to auto loans and corporate credit — costlier over time. Those higher borrowing costs, in turn, could slow consumer spending and hiring. The gravest risk is that the Fed’s abandonment of low rates could trigger another recession.

The Fed had to do something. Inflation is virtually out of control.

This morning Syracuse.com reports that the increase in rates will cause an increase in car, home, and other loan payments:

With the Federal Reserve signaling Wednesday that it will begin raising its benchmark interest rate as soon as March — and probably a few additional times this year — consumers and businesses will eventually feel it.

The Fed’s thinking is that with America’s job market essentially back to normal and inflation surging well beyond the central bank’s annual 2% target, now is the time to raise its benchmark rate from near zero.

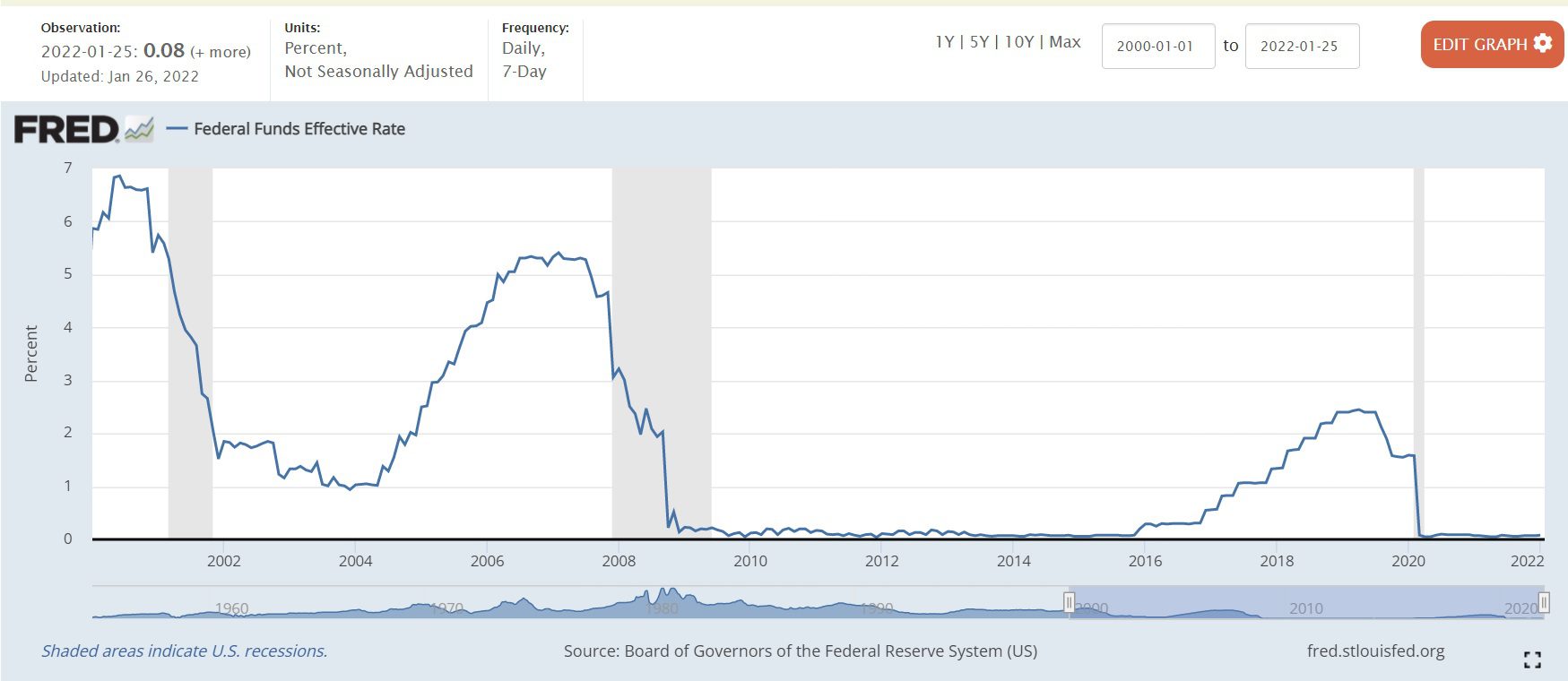

With massive inflation, the Fed has to do something, but their preferred action with Democrats in office is to keep the rates at zero. Since 2000 the Fed increased interest rates only once by a quarter of a percent under a Democrat President (Obama). This policy has helped the economies during their time in office by keeping the cost of borrowing at low rates.

Under Bush and Trump, the Fed increased rates numerous times. Their rate increases in 2006 and 2007 helped exacerbate the 2007 housing bubble crash. Their increases in rates under President Trump almost killed the economy in 2018, the strongest economy in US history. The rates for Obama and Biden have been at zero for all their time in office with the exception of 2016, when the Fed increased the rates a quarter of a percent. Under President Trump, the Fed increased rates eight times before moving back to zero during the COVID crisis in 2020. They have remained at zero ever since.

The economy must be really bad for the Fed to increase rates at this time.

The post To Combat Biden’s Massive Inflation, the Fed Announces It Will Reluctantly Increase Rates, Something Extremely Rare Under Democrat Administrations — You Won’t Believe the Numbers! appeared first on The Gateway Pundit.